Unified Pension Scheme (UPS) has been approved by Union Cabinet chaired by the Prime Minister Shri Narendra Modi on 24th August 2024. This UPS Scheme 2024 for central government employees has better features than the previous National Pension Scheme (NPS). Under this Unified Pension Scheme, the central govt. will provide assured pension, family pension and minimum pension to 23 lakh government employees. UPS will come into effect from 1st April 2025. Read this article till the end to know UPS assured pension, family pension, minimum pension amount and other aspects regarding the scheme.

Unified Pension Scheme 2024 Features

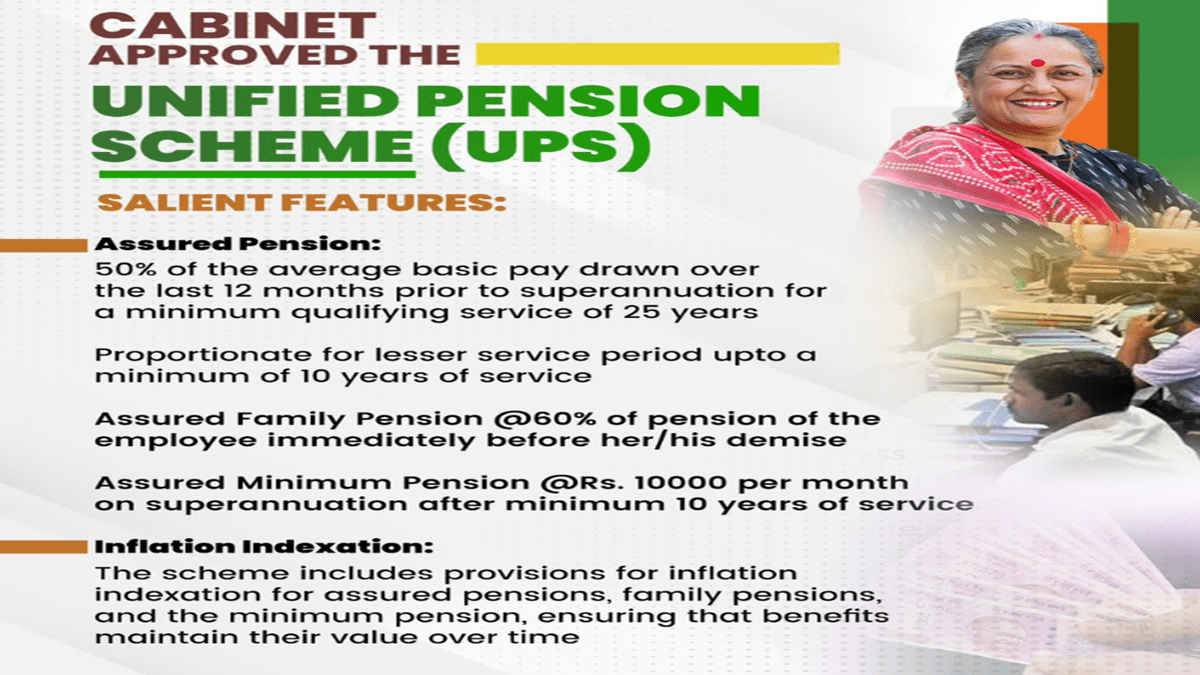

Unified Pension Scheme will significantly enhance the sense of security among government employees, offering them assured pensions, family pensions, and minimum pensions. State governments will also have the option to adopt the UPS scheme. The salient features of Unified Pension Scheme (UPS) are hereby mentioned.

Assured Pension

Under Unified Pension Scheme, retirees will receive a pension amounting to 50% of the average basic pay drawn over the last 12 months prior to retirement, for a minimum qualifying service of 25 years. The pension will be proportionate for those with shorter service periods, with a minimum requirement of 10 years of service.

Assured Family Pension

In the event of an employee’s death, their family will be eligible to receive 60% of the pension amount that the employee was receiving immediately before their death. This ensures financial security for the employee’s dependents.

Assured Minimum Pension

The new scheme guarantees a minimum pension of Rs. 10,000 per month on superannuation after a minimum of 10 years of service, providing a safety net for employees with lower salaries.

Inflation Indexation

The assured pension, family pension, and minimum pension will be indexed to inflation, ensuring that benefits maintain their value over time.

Dearness Relief

Dearness Relief (DR) will be based on All India Consumer Price Index for Industrial Workers (AICPI-IW) as in case of service employees.

Lump Sum Payment

In addition to gratuity, employees will receive a lump sum payment at retirement equivalent to 1/10th of their monthly emoluments (pay + DA) as of the retirement date for every completed six months of service. This payment will not affect the amount of the assured pension.

UPS Vs NPS – Scheme Options

Central govt. employees will have the option to choose between the unified pension scheme (UPS) and the existing new pension scheme (NPS).

Pension Contribution

The staff contribution to the Unified Pension scheme will remain at 10%, unchanged from the previous structure. However, the central govt’s contribution will be reassessed every 3 years.

Expenditure on UPS Scheme

The financial implications includes a total expenditure of Rs. 800 crore for arrears, with an estimated initial annual cost of Rs. 6,250 crore for the UPS Scheme.

Overview of UPS Scheme by Central Government

| Name of Scheme | Unified Pension Scheme |

| in Short | UPS Scheme |

| Major Beneficiaries | Central Government Employees |

| Number of Beneficiaries | 23 lakh |

| Features | Assured pension, family pension, minimum pension, inflation indexation, dearness relief & lump sum payment |

| Cabinet Approval Date | 24 August 2024 |

| Scheme Effective From | 1st April 2025 |

PM Modi on UPS for Central Govt Employees

PM Modi wrote on X “We are proud of the hard work of all government employees who contribute significantly to national progress. The Unified Pension Scheme ensures dignity and financial security for government employees, aligning with our commitment to their well-being and a secure future.”

Union Minister Ashwini Vaishnaw stated that the Centre had constituted a committee that held 100 meetings with several top organisations, including the RBI and the World Bank, to finalise the details of the Unified Pension Scheme (UPS).

Source / Reference link: https://pib.gov.in/PressReleasePage.aspx?PRID=2048607

![NPS Vatsalya Scheme Apply Online [y] - How to Open NPS Vatsalya Account NPS Vatsalya Scheme Apply Online Process](https://hindustanyojana.in/wp-content/uploads/2024/09/nps-vatsalya-scheme-apply-online-process.png)

![National Pension Scheme (NPS) Online Registration Form [y] at enps.nsdl.com National Pension Scheme Online Registration Form](https://hindustanyojana.in/wp-content/uploads/2024/09/national-pension-scheme-online-registration-form.png)

![NPS Traders Scheme [y] Online Registration Form, Contribution Chart, Eligibility, Benefits National Pension Scheme Traders Self Employed Persons Apply Online Process](https://hindustanyojana.in/wp-content/uploads/2024/08/national-pension-scheme-traders-self-employed-persons-apply-online-process.png)

![List of Top 25 Agricultural Schemes in India [y] for Welfare of Farmers List of Top 25 Agricultural Schemes in India](https://hindustanyojana.in/wp-content/uploads/2024/08/list-of-top-25-agricultural-schemes-in-india.png)