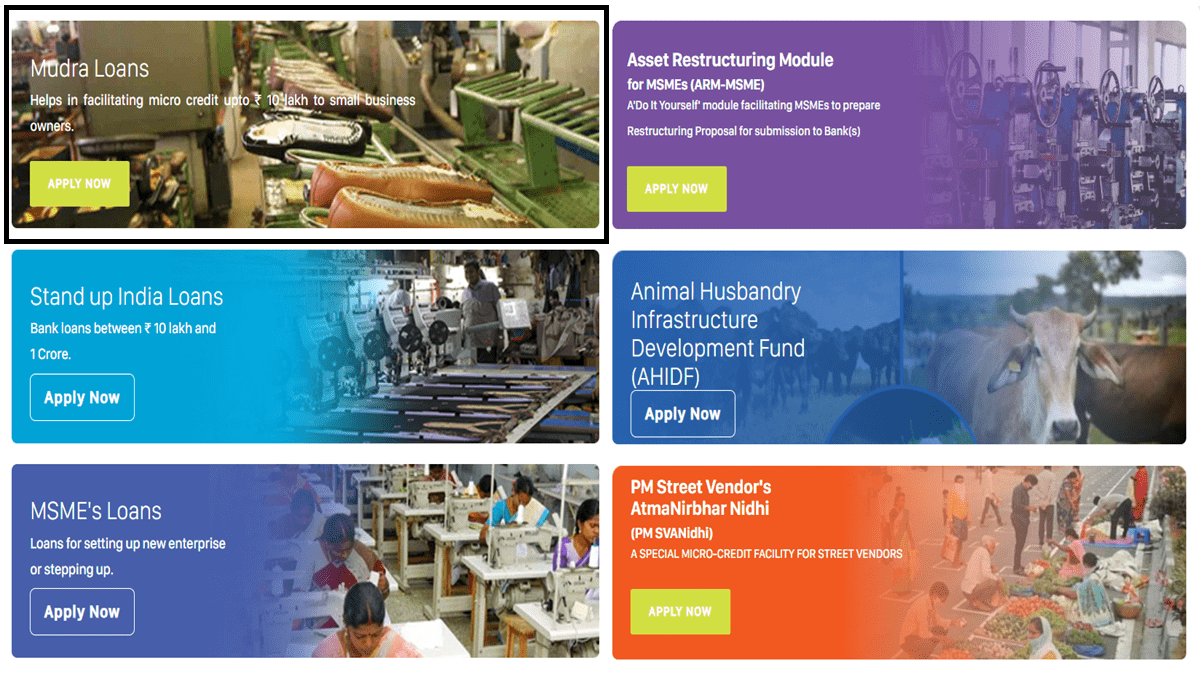

Stand Up India Loan apply online process started at standupmitra.in, SC/ST and women entrepreneurs can check eligibility, documents required for registration. Under Standup India Scheme, the central govt. facilitate bank loans between Rs. 10 lakh and Rs. 1 Crore to the beneficiary. The Stand-Up India scheme beneficiaries includes atleast one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch for setting up a greenfield enterprise. This enterprise may be in manufacturing, services, agri-allied activities or the trading sector. In case of non-individual enterprises at least 51% of the shareholding and controlling stake should be held by either an SC/ST or woman entrepreneur.

Stand-Up India scheme was initially launched by the Hon’ble Prime Minister of India on 5th April 2016. Read this article till the end to know how to fill Stand Up India loan online application form, what is the eligibility criteria for registration, documents required and other aspects regarding the scheme.

Stand Up India Loan Online Application Form 2024

Here we are describing complete Stand Up India Loan apply online process:-

- Firstly visit the official website https://standupmitra.in/

- At the homepage, reach out to ‘You may access loans‘ section and click “Apply Here” tab.

- Direct link – https://standupmitra.in/Login/Register#NoBack

- Upon clicking the link, the Stand Up India Loan Registration page as shown below:-

- Enter name of applicant, email, mobile number and click “Generate OTP” button.

- Verify the OTP received on the registered mobile number to complete the registration process.

- Then you would be logged in where you can see Stand Up India Loan Online Application Form 2024.

- Select gender, category of applicant, state, district, minority status, educational qualification, job experience status, present employment status, identified project, nature of business, enter city/town, Pincode, date of birth and other details.

- After filling in the details accurately in the Stand Up India Loan Online Apply Form, click at “Submit” button.

- After SUI Scheme form submission, bank picks up application from marketplace for review / processing.

- If all the details are found correct, then loan amount is sanctioned and sent for disbursement.

Stand Up India Loan Eligibility Criteria

- SC / ST and /or Women entrepreneurs, above 18 years of age

- Loans under the scheme is available only for Green Field Projects. Green Field signifies, in this context, the first time venture of the beneficiary in the manufacturing or services or agri-allied activities or trading sector.

- In case of non-individual enterprises, 51% of the shareholding and controlling stake should be held by either SC/ST and/or Women Entrepreneur.

- Borrower should not be in default to any Bank / Financial Institution.

Stand Up India Loan Eligibility Check – https://standupmitra.in/Home/SUISchemes

Documents Required for Stand-Up India Loan

- Identity Proof: Voter’s ID, passport, driving license, PAN card, or signature identification from your bank

- Residence Proof: Recent phone or electricity bills, property tax receipt, or passport

- Proof of Category: Caste certificate, Aadhaar card, or other document issued by the competent authority if you’re an SC/ST borrower

- Proof of business: Business plan, project report, feasibility report, or market survey report

- Other Documents:

- Bank account details

- Details of investment in proposed project

- Information about whether you need help raising margin money

- Any previous business experience

- Details about your manufacturing process, executives, tie-ups, raw materials, suppliers, buyers, competitors, and your company’s strengths and weaknesses

Stand-Up India Loan Amount

Stand-Up India Scheme facilitates bank loans b/w Rs. 10 lakh to Rs. 1 crore to atleast one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch for setting up a greenfield enterprise.

This enterprise may be in manufacturing, services, agri-allied activities or the trading sector. In case of non-individual enterprises at least 51% of the shareholding and controlling stake should be held by either an SC/ST or woman entrepreneur.

Stand Up India Loan Interest Rate

The rate of interest for Stand Up India Loans would be lowest applicable rate of the bank for that category (rating category) not to exceed (base rate (MCLR) + 3%+ tenor premium). The Stand-up India loan is repayable in 7 years with maximum moratorium period of 18 months.

In order to draw working capital upto Rs. 10 lakh, the same may be sanctioned by way of overdraft. Rupay debit card would be issued for convenience of the borrower. Working capital limit of more than Rs. 10 lakh would be sanctioned by way of cash credit limit.

Stand Up India Scheme is being operated by all branches of Scheduled Commercial Banks in India.

Salient Features of Standup India Scheme

- Borrower Type: Loans to SC/ST and women entrepreneurs above 18 years of age.

- Enterprise: Loans for setting up greenfield enterprise.

- Size of Bank Loans: Scheme facilitate bank loans between Rs. 10 lakh and Rs. 1 crore

- Nature of Loan: Composite Loan upto 85% of project cost (inclusive of term loan and working capital).

- Purpose of loan – For manufacturing, services, agri-allied activities or trading sector.

- Promoter Contribution: 15% margin money.

- Security: Security cover under Credit Guarantee Fund Scheme for Stand-up India Loans (CGFSIL).

To check SUI Scheme guidelines, visit the Stand Up India Portal at https://www.standupmitra.in/

![List of Top 25 Agricultural Schemes in India [y] for Welfare of Farmers List of Top 25 Agricultural Schemes in India](https://hindustanyojana.in/wp-content/uploads/2024/08/list-of-top-25-agricultural-schemes-in-india.png)

![PSB Loans in 59 Minutes Registration [y] & Login - Apply Online for Home, Auto, Personal Loans Apply Online PSB Loans in 59 Minutes](https://hindustanyojana.in/wp-content/uploads/2024/08/apply-online-psb-loans-in-59-minutes.png)

![pmayg.nic.in Online Apply [y]: PMAY Gramin Registration Form 2.0 pmayg.nic.in Awaassoft Data Entry](https://hindustanyojana.in/wp-content/uploads/2024/08/pmayg-nic-in-awaassoft-data-entry.png)

![PM Internship Scheme Portal Registration [y] & Login at pminternship.mca.gov.in PM Internship Yojana Registration](https://hindustanyojana.in/wp-content/uploads/2024/09/pm-internship-yojana-registration.png)

![PMMVY Registration [y] - Apply Online for Rs. 5000 at pmmvy.wcd.gov.in PMMVY Registration Online](https://hindustanyojana.in/wp-content/uploads/2024/09/pmmvy-registration-online.png)