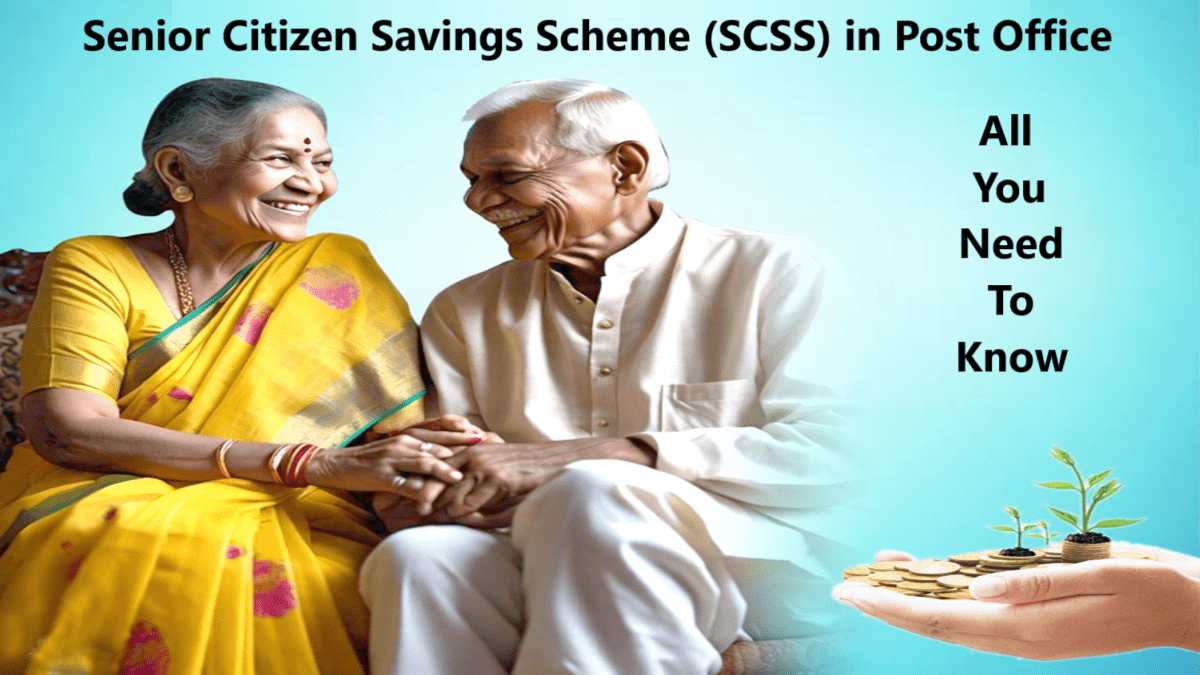

Post Office Senior Citizen Savings Scheme (SCSS) Interest Rate for the present quarter October to December 2024 has been notified by central government. One can now check new interest rates payable to the beneficiaries of SCSS post office scheme.

Read this article till the end to know what is interest rate offered in Senior Citizen Saving Scheme in Post Office, what is minimum amount to open SCSS account and how much maximum balance can be retained. Even check how to make deposits in SCSS account, what are the tax benefits and premature withdrawal conditions.

Senior Citizen Savings Scheme Interest Rate 2024

- SCSS account shall earn on the prescribed rate as notified by Ministry of Finance on quarterly basis.

- Interest Rate on Senior Citizen Savings Scheme in Post Office is 8.20% Per Annum (with effect from 1 October 2024).

- Interest shall be payable on quarterly basis and applicable from the date of deposit to 31st March/30th June/30th September/31st December.

- In case the SCSS account holder does not claims the interest payable every quarter, such interest shall not earn additional interest.

- Interest can be drawn through auto credit into savings account standing at same post office, or ECS. If SCSS account is with CBS Post offices, then monthly interest can be credited into savings account standing at any CBS Post Offices.

Min Amount & Max Balance in SCSS Account

- There shall be only one deposit in the account in multiple of INR. 1000

- Maximum balance that can be retained in Senior Citizen Saving Scheme account must not exceed Rs. 30 lakh.

Who can open Senior Citizen Saving Scheme Account

- Any individual above 60 years of age i.e any senior citizen can open this SCSS account.

- Retired Civilian Employees b/w the age of 55 to 60 years, subject to condition that investment to be made within 1 month of receipt of retirement benefits.

- Retired Defense Employees b/w the age of 50 to 60 years, subject to condition that investment to be made within 1 month of receipt of retirement benefits.

- Account can be opened in wither an individual capacity or jointly with spouse only.

- The whole amount of deposit in a joint account of SCSS shall be attributable to the first account holder only.

Deposits in Senior Citizens Savings Scheme Account

- Minimum deposit shall be Rs. 1000 and in multiple of 1000, subject to maximum limit up to Rs. 30 lakh in all SCSS accounts opened by an individual.

- In case any excess deposit made in SCSS account, excess amount will be refunded immediately to the depositor. Moreover, only PO Savings Account Interest rate will be applicable from the date of excess deposit to the date of refund.

Senior Citizens Savings Scheme Tax Benefits

- Investment under SCSS scheme qualifies for the benefit of section 80C of Income Tax Act, 1961.

- Interest is taxable if total interest in all SCSS accounts exceeds Rs. 50,000 in a financial year. In addition to this, TDS at the prescribed rate shall be deducted from the total interest paid. No TDS will be deducted if form 15 G/15H is submitted and accrued interest is within prescribed limit.

Premature Withdrawal in Senior Citizen Savings Scheme Account

- Account can be prematurely closed any time after date of opening.

- If account closed before 1 year, no interest will be payable and if any interest paid in account shall be recovered from principle.

- If account closed after 1 year but before 2 year from the date of opening, an amount equal to 1.5 % will be deducted from principal amount.

- If account closed after 2 year but before 5 year from the date of opening, an amount equal to 1 % will be deducted from principal amount.

- Extended account can be closed after the expiry of one year from the date of extension of the account without any deduction.

Maturity of SCSS Account in Post Office

- Account may be closed after 5 year from the date of opening by submitting prescribed application form with passbook at concerned Post Office.

- In case of death of account holder, from the date of death, account shall earn interest at the rate of PO Savings Account.

- In case spouse is a joint holder or a sole nominee, account can be continued till maturity if spouse is eligible to open SCSS account and not have another SCSS Account.

Extension of Senior Citizen Saving Scheme Account

- Account holder may extend the account for further period for 3 years from the date of maturity by submitting prescribed form with passbook at concerned post office.

- Account can be extended within 1 year of maturity.

- Extended account shall earn interest at the rate applicable on the date of maturity.

Note:- Senior Citizen Savings Scheme Rules

Check Here – Senior Citizen Saving Scheme Forms

For more details on Senior Citizen Savings Scheme, visit the India Post official website https://www.indiapost.gov.in/Financial/Pages/Content/Post-Office-Saving-Schemes.aspx

![Sukanya Samriddhi Yojana Interest Rate [y] - Check New Interest Payable on PO Scheme for Girl Child Sukanya Samriddhi Yojana Interest Rate](https://hindustanyojana.in/wp-content/uploads/2024/10/sukanya-samriddhi-yojana-interest-rate.png)

![Monthly Income Scheme in Post Office Interest Rate [y], Deposits, Premature Withdrawal, Details Monthly Income Scheme in Post Office](https://hindustanyojana.in/wp-content/uploads/2024/12/monthly-income-scheme-in-post-office.png)

![Post Office Small Savings Scheme Interest Rates Table [1 October - 31 December 2024] Post Office Small Savings Scheme Interest Rates Table](https://hindustanyojana.in/wp-content/uploads/2024/09/post-office-small-savings-scheme-interest-rates-table.png)

![Mahila Samman Bachat Patra Yojana [y] Form PDF, Last Date Mahila Samman Bachat Patra Yojana Apply Online](https://hindustanyojana.in/wp-content/uploads/2024/11/mahila-samman-bachat-patra-yojana-apply-online.png)