Central govt has launched a revamped Model Skill Loan Scheme 2024 to enhance accessibility to skill development courses. Under the revised scheme, maximum loan limit has been increased from Rs. 1.5 lakh to Rs. 7.5 lakh. Under revamped MSLS, govt. will provide loans upto Rs. 7,50,000 with a guarantee from a government promoted fund. It is expected that this new version of scheme will benefit 25,000 students every year. Read this article till the end to know Model Skill Loan Scheme complete details.

What is Revamped Model Skill Loan Scheme 2024?

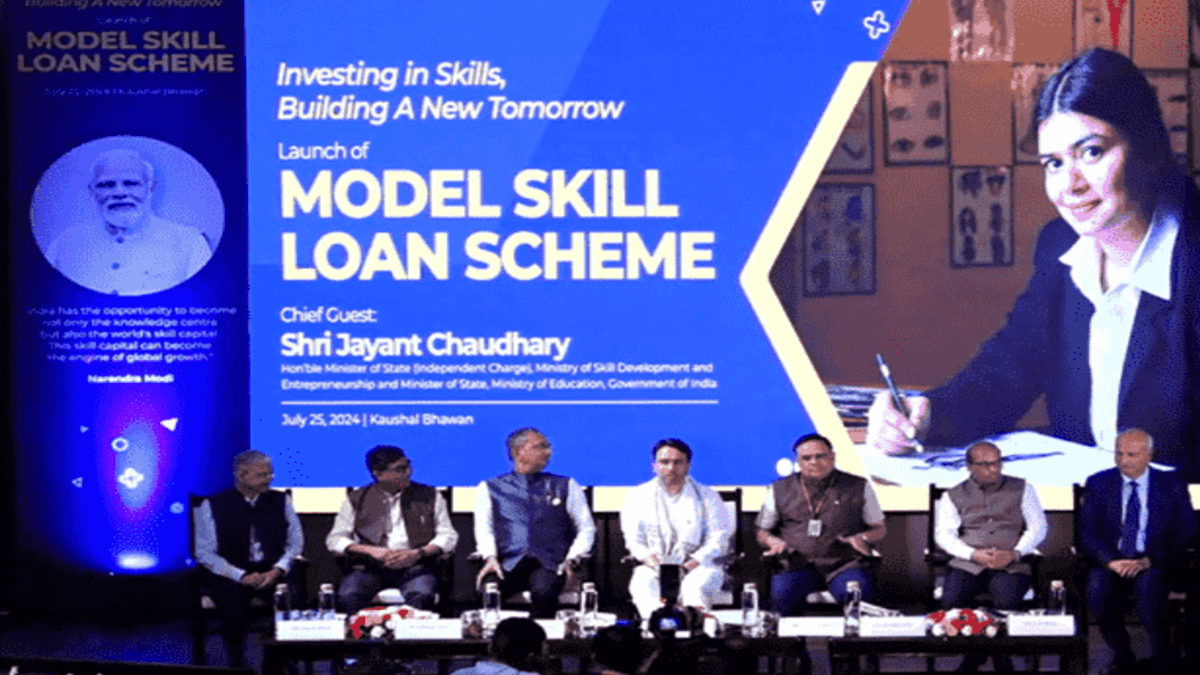

Minister of State for Skill Development and Entrepreneurship, Jayant Chaudhary, has launched the Revamped Model Skill Loan Scheme in New Delhi. The scheme aims to empower the country’s future-ready workforce. Under the scheme, education and upskilling opportunities will be provided to 25,000 youth across the country.

New Loan Amount Limit in Model Skill Loan Scheme

Addressing the launch event, Mr. Chaudhary said that under the new Model Skill Loan scheme, the loan amount limit has been increased to 7.5 lakh rupees which was 1.5 lakh rupees earlier. He added that several Non-Banking Financial Companies (NBFC), scheduled banks, and rural banks also have been added to the scheme which will provide hassle-free loans to students. The Minister said that this scheme had been mentioned by the Union Finance Minister Nirmala Sitharaman in Union Budget 2024-25.

Key Features of New Model Skill Loan Scheme

- New Model Skill Loan Scheme is tailored to support advanced-level skill courses, which often come with higher fees, creating a significant financial barrier for many deserving students.

- This initiative aims to bridge that gap, ensuring that aspiring candidates receive the necessary financial support to pursue their skill training.

- Initially launched in 2015, the old scheme saw low uptake due to insufficient loan limits.

- In the revamped model skill loan scheme, the loan amount limit has been increased to Rs. 7.5 lakh which was Rs. 1.5 lakh earlier.

- Announced in the Union Budget 2024-2025, the revised scheme aims to benefit 25,000 students annually. It now includes non-banking financial companies (NBFCs), NBFC-MFIs (micro-finance institutions), and small finance banks as eligible lending institutions.

- The revised scheme will now allow access to more skill courses, against only national skill qualification framework (NSQF)-aligned courses under the old skill loan scheme. Also, non-NSQF courses that are onboarded on the Skill India Digital Hub platform will come under the scheme.

- As of March 2024, loans amounting to Rs 115.75 crore were extended to 10,077 borrowers, highlighting low fund utilisation due to high course fees.

Revamped Model Skill Loan Scheme in Union Budget 2024-25

Finance Minister Nirmala Sitharaman presented Union Budget 2024-25 on 23rd July 2024. While delivering the budget speech, she said “The Model Skill Loan Scheme will be revised to facilitate loans up to Rs. 7.5 lakh with a guarantee from a government promoted Fund. This measure is expected to help 25,000 students every year.”

Old Skill Loan Scheme Operational Guidelines: https://www.msde.gov.in/en/schemes-initiatives/Other-Schemes-and-Initiatives/Skill-Loan-Scheme

![List of Top 25 Agricultural Schemes in India [y] for Welfare of Farmers List of Top 25 Agricultural Schemes in India](https://hindustanyojana.in/wp-content/uploads/2024/08/list-of-top-25-agricultural-schemes-in-india.png)

![PM Internship Scheme Portal Registration [y] & Login at pminternship.mca.gov.in PM Internship Yojana Registration](https://hindustanyojana.in/wp-content/uploads/2024/09/pm-internship-yojana-registration.png)

![PSB Loans in 59 Minutes Registration [y] & Login - Apply Online for Home, Auto, Personal Loans Apply Online PSB Loans in 59 Minutes](https://hindustanyojana.in/wp-content/uploads/2024/08/apply-online-psb-loans-in-59-minutes.png)