Pradhan Mantri Mudra Yojana Application Form 2024 available to download in PDF format at mudra.org.in. PMMY Bankers Kit has common loan application form for Kishor and Tarun loans and application form for Shishu loans. Under the aegis of central govt’s PMMY, Mudra has created three products namely ‘Shishu’, ‘Kishore’ and ‘Tarun’. These product signifies the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur. The 3 products also provide a reference point for the next phase of graduation / growth.

Mudra Loan scheme was firstly launched by the Hon’ble Prime Minister Narendra Modi on 8 April 2015. Under this scheme, central govt. will provide loans up to Rs. 10 lakh (Rs. 20 lakh on prompt repayment of tarun loans) to the non-corporate, non-farm small/micro enterprises. These loans are classified as Mudra loans under PMMY. The Mudra loans are given by Commercial Banks, RRBs, Small Finance Banks, MFIs and NBFCs. The borrower can approach any of the lending institutions with PM Mudra Yojana application form PDF and required documents or can apply online for Mudra Loans through www.udyamimitra.in portal.

Read this article till the end to know how to download Shishu, Kishore, Tarun loan forms under Pradhan Mantri Mudra Yojana.

Types of Loans under PM Mudra Yojana 2024

| Type of Mudra Loan | Loan Amount |

|---|---|

| Shishu | Loans upto Rs. 50,000 are categorized as Shishu |

| Kishore | Loans from Rs. 50,001 to Rs. 500,000 are categorized as Kishore |

| Tarun | Loans from Rs. 500,001 to Rs. 10,00,000 are categorized as Tarun. On prompt repayment of earlier loans, beneficiary can get loans upto Rs. 20,00,000. |

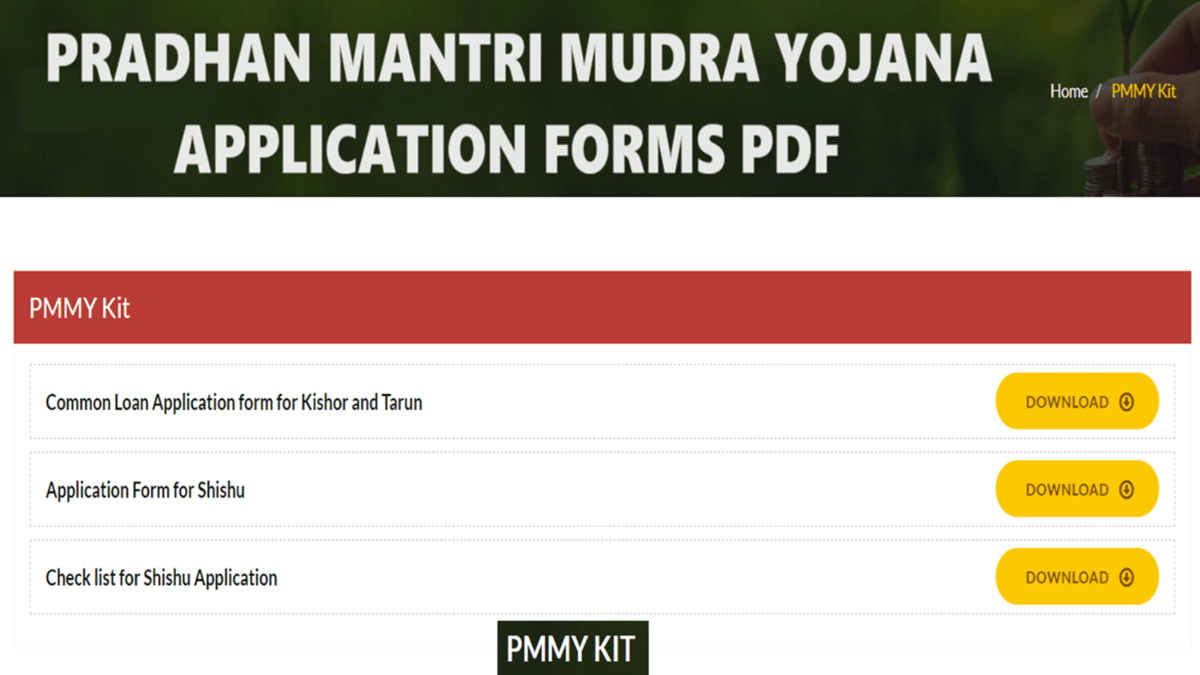

Pradhan Mantri Mudra Yojana Application Form PDF

Shishu, Kishore, Tarun Loan Application Forms are available to download through PMMY Bankers Kit available at mudra.org.in. The direct links to download forms for these 3 categories of Mudra Loans is given here. You can download Pradhan Mantri Mudra Yojana Application Form PDF depending on your loan amount through the link – https://www.mudra.org.in/Home/PMMYBankersKit

Tarun / Kishore Mudra Loan Form Download

If you want to take a mudra loan b/w Rs. 50,000 to Rs. 5 lakh, then you can apply for Kishore Loan. However, if you want to take mudra loan b/w Rs. 5 lakh to Rs. 10 lakh, then you can apply for Tarun Loan. The application form for both these types of mudra loan is common which you can download through the link – Tarun / Kishore Mudra Loan Application Form PDF. Upon clicking the link, the common loan application form for Kishor and Tarun will appear as shown below:-

Fill out this kishore / tarun mudra loan application form to get loans b/w Rs. 50,000 to Rs. 20,00,000.

Shishu Mudra Loan Application Form Download

If you want to take a mudra loan upto Rs. 50,000, then you can apply for Shishu Loan. The application form for Shishu loan can be downloaded in PDF format through the link – Shishu Mudra Loan Application Form PDF. Upon clicking this link, the Pradhan Mantri Mudra Yojana application form for shishu loan will open.

Fill out this Shishu Mudra Yojana application form to get loans upto Rs. 50,000.

List of Documents Required for Shishu Mudra Loan

Here is the complete list of documents which are required to be submitted along with application.

- Proof of identity- Self attested copy of Voter’s ID card/Driving Licence/PAN Card/Aadhaar Card/Passport/Photo IDs issued by Govt. authority etc.

- Proof of Residence- Recent telephone bill/electricity bill/property tax receipt (not older than 2 months)/ Voter’s ID card / Aadhaar Card / Passport of Individual/Proprietor/Partners/Bank passbook or latest account statement duly attested by Bank officials/Domicile certificate/certificate issued by Govt. authority/Local panchayat/Municipality etc.

- Applicant’s Recent Photograph (2 copies) not older than 6 months.

- Quotation of Machinery/other items to be purchased

- Name of supplier/details of machinery/price of machinery and/or items to be purchased.

- Proof of Identity/Address of the Business Enterprise- Copies of relevant licenses/registration certificates/other documents pertaining to the ownership, identity and address of business unit, if any

- Proof of category like SC/ST/OBC/Minority etc.

Note

- No processing fee

- No collateral

- Repayment period of loan is extended up to 5 years.

- Applicant should not be defaulter of any Bank/Financial institution.

There are no agents or middleman engaged by MUDRA for availing of Mudra Loans. The borrowers are advised to keep away from persons posing as Agents/ facilitators of MUDRA/PMMY.

Increase in Loan Limit under PMMY Scheme

On 23rd July 2024, Finance Minister announced to increase the limit of Mudra loans to Rs. 20 lakh from the existing Rs. 10 lakh for those entrepreneurs who have availed and successfully repaid previous loans under the Tarun category.

Also Read: How to Apply Online for Mudra Loans

Pradhan Mantri Mudra Yojana Progress Report (Year Wise)

- Financial Year :2015-2016

- No. of PMMY Loans Sanctioned :34880924

- Amount Sanctioned : 137449.27 Crore

- Amount Disbursed : 132954.73 Crore

- Last Update on: 31/03/2016

- Financial Year :2016-2017

- No. of PMMY Loans Sanctioned :39701047

- Amount Sanctioned : 180528.54 Crore

- Amount Disbursed : 175312.13 Crore

- Last Update on: 31/03/2017

- Financial Year :2017-2018

- No. of PMMY Loans Sanctioned :48130593

- Amount Sanctioned : 253677.10 Crore

- Amount Disbursed : 246437.40 Crore

- Last Update on: 31/03/2018

- Financial Year :2018-2019

- No. of PMMY Loans Sanctioned :59870318

- Amount Sanctioned : 321722.79 Crore

- Amount Disbursed : 311811.38 Crore

- Last Update on: 31/03/2019

- Financial Year :2019-2020

- No. of PMMY Loans Sanctioned :62247606

- Amount Sanctioned : 337495.53 Crore

- Amount Disbursed : 329715.03 Crore

- Last Update on: 31/03/2020

- Financial Year :2020-2021

- No. of PMMY Loans Sanctioned :50735046

- Amount Sanctioned : 321759.25 Crore

- Amount Disbursed : 311754.47 Crore

- Last Update on: 31/03/2021

- Financial Year :2021-2022

- No. of PMMY Loans Sanctioned :53795526

- Amount Sanctioned : 339110.35 Crore

- Amount Disbursed : 331402.20 Crore

- Last Update on: 31/03/2022

- Financial Year :2022-2023

- No. of PMMY Loans Sanctioned :62310598

- Amount Sanctioned : 456537.98 Crore

- Amount Disbursed : 450423.66 Crore

- Last Update on: 31/03/2023

- Financial Year :2023-2024

- No. of PMMY Loans Sanctioned :66777013

- Amount Sanctioned : 541012.86 Crore

- Amount Disbursed : 532358.35 Crore

- Last Update on: 31/03/2024

- Financial Year :2024-2025

- No. of PMMY Loans Sanctioned :13500477

- Amount Sanctioned : 135124.40 Crore

- Amount Disbursed : 130001.65 Crore

- Last Update on: 16/08/2024

For more details, visit the official website of Pradhan Mantri Mudra Yojana at https://www.mudra.org.in/

![All India ODOP List [y] PDF - Check State / District Wise ODOP Products under PMFME Scheme ODOP List PDF State District Wise](https://hindustanyojana.in/wp-content/uploads/2024/08/odop-list-pdf-state-district-wise.png)

![Jan Aushadhi Kendra Medicine List [y] - Check Product List with Price How to Check Jan Aushadhi Kendra Medicine List](https://hindustanyojana.in/wp-content/uploads/2024/08/how-to-check-jan-aushadhi-kendra-medicine-list.png)

![List of Top 25 Agricultural Schemes in India [y] for Welfare of Farmers List of Top 25 Agricultural Schemes in India](https://hindustanyojana.in/wp-content/uploads/2024/08/list-of-top-25-agricultural-schemes-in-india.png)

![PM Internship Scheme Portal Registration [y] & Login at pminternship.mca.gov.in PM Internship Yojana Registration](https://hindustanyojana.in/wp-content/uploads/2024/09/pm-internship-yojana-registration.png)