Post Office Small Savings Scheme Interest Rates Table is now available, check new interest rates on PO schemes for duration of 1st October to 31 December 2024. Revision of interest rates for small savings schemes is carried out by Indian government at an interval of every 3 months. Small savings scheme interest rate are revised in India for 4 times in a particular year. For the current quarter, check the new interest rates for PO small savings schemes.

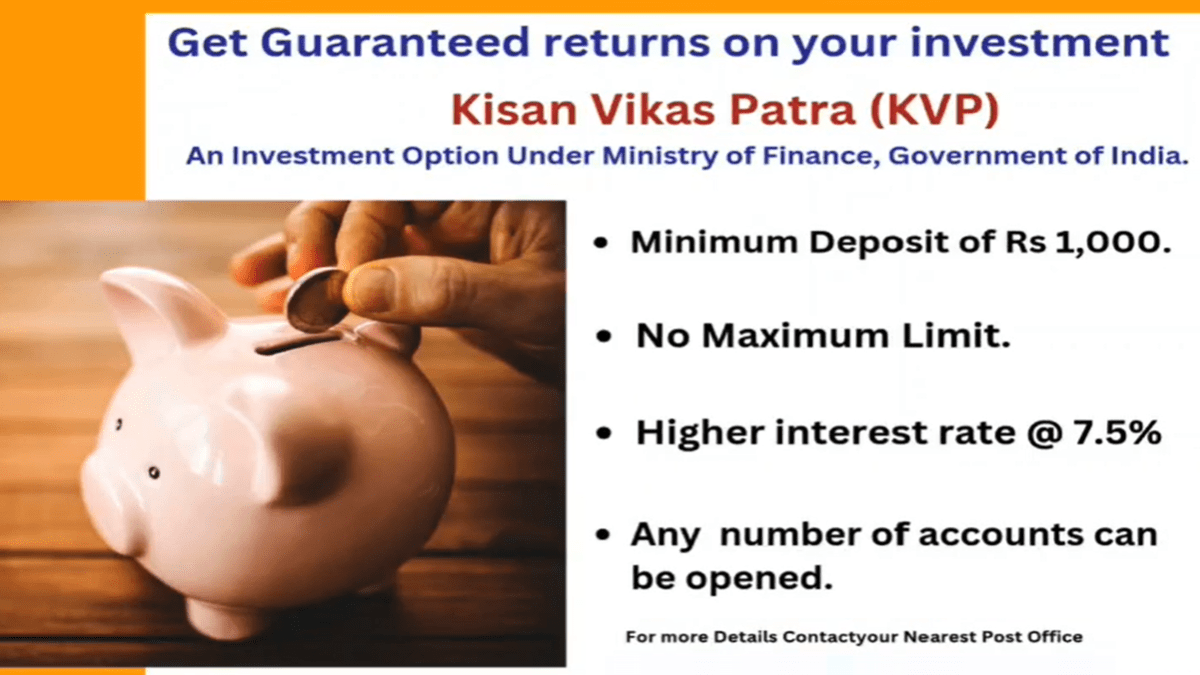

The interest rates for Time Deposit (TD), Public Provident Fund (PPF), Sukanya Samriddhi account, Senior Citizen Savings Schemes (SCSS), Recurring Deposit (RD), National Savings Certificate (NSC), Kisan Vikas Patra (KVP), Monthly Income Scheme (MIS) and PO Savings Deposit Account have been kept unchanged in Oct to Dec 2024 duration. Read this article till the end to check Post Office Interest Rates Table 2024 for the present quarter.

PO Small Savings Scheme Interest Rates 2024

| Name of Post Office Scheme | Interest Rate |

|---|---|

| Savings Deposit | 4% |

| 1 Year Time Deposit | 6.9% |

| 2 Year Time Deposit | 7.0% |

| 3 Year Time Deposit | 7.1% |

| 5 Year Time Deposit | 7.5% |

| Five Year Recurring Deposit | 6.7% |

| Senior Citizen Savings Scheme | 8.2% |

| Monthly Income Scheme | 7.4% |

| National Savings Certificate | 7.7% |

| Public Provident Fund Scheme | 7.1% |

| Kisan Vikas Patra | 7.5% (will mature in 115 months) |

| Sukanya Samriddhi Yojana Account | 8.2% |

Small Savings Scheme Interest Rate Kept Unchanged

Finance ministry has not raised interest rates on small savings schemes for the present quarter i.e October to December 2024 quarter. The rates on the various instruments have not been increased this time and same interest rates would be given to the respective PO small savings scheme account holders. As per the statement issued, the revised PO small savings scheme interest rates ranges from 4% to 8.2%.

The PO small savings scheme interest rates, while set by the government, are linked to market yields on government securities at a spread of 0-100 basis points over the yield of these securities of comparable maturities. However, interest rates on small savings have not always tracked the movement in market rates.

Source/Reference link: https://www.indiapost.gov.in/vas/Pages/IndiaPostHome.aspx

![[SCSS] Post Office Senior Citizen Saving Scheme Interest Rate [y], Min Deposit, Max Balance, Tax Benefits Senior Citizen Savings Scheme Interest Rate](https://hindustanyojana.in/wp-content/uploads/2024/12/senior-citizen-savings-scheme-interest-rate.png)

![Sukanya Samriddhi Yojana Interest Rate [y] - Check New Interest Payable on PO Scheme for Girl Child Sukanya Samriddhi Yojana Interest Rate](https://hindustanyojana.in/wp-content/uploads/2024/10/sukanya-samriddhi-yojana-interest-rate.png)

![Monthly Income Scheme in Post Office Interest Rate [y], Deposits, Premature Withdrawal, Details Monthly Income Scheme in Post Office](https://hindustanyojana.in/wp-content/uploads/2024/12/monthly-income-scheme-in-post-office.png)

![Mahila Samman Bachat Patra Yojana [y] Form PDF, Last Date Mahila Samman Bachat Patra Yojana Apply Online](https://hindustanyojana.in/wp-content/uploads/2024/11/mahila-samman-bachat-patra-yojana-apply-online.png)