Kisan Rin Portal login process has been started at fasalrin.gov.in by the central government on 19 September 2023. KRP is poised to revolutionize access to credit services under the Kisan Credit Card (KCC). It will also assist farmers in availing subsidized agriculture credit through the Modified Interest Subvention Scheme (MISS). PM Kisan Rin Portal serves as an integrated hub, offering a comprehensive view of farmer data, loan disbursement specifics, interest subvention claims and scheme utilization progress.

By fostering seamless integration with banks, this fasalrin.gov.in pioneering portal enables proactive policy interventions, strategic guidance, and adaptive enhancements for more focused and efficient agriculture credit and optimum utilization of interest subvention. Kisan Rin Portal has been developed collaboratively by MoA&FW, the Department of Financial Services (DFS), Department of Animal Husbandry & Dairying (DAH&D), Department of Fisheries (DoF), RBI, and NABARD.

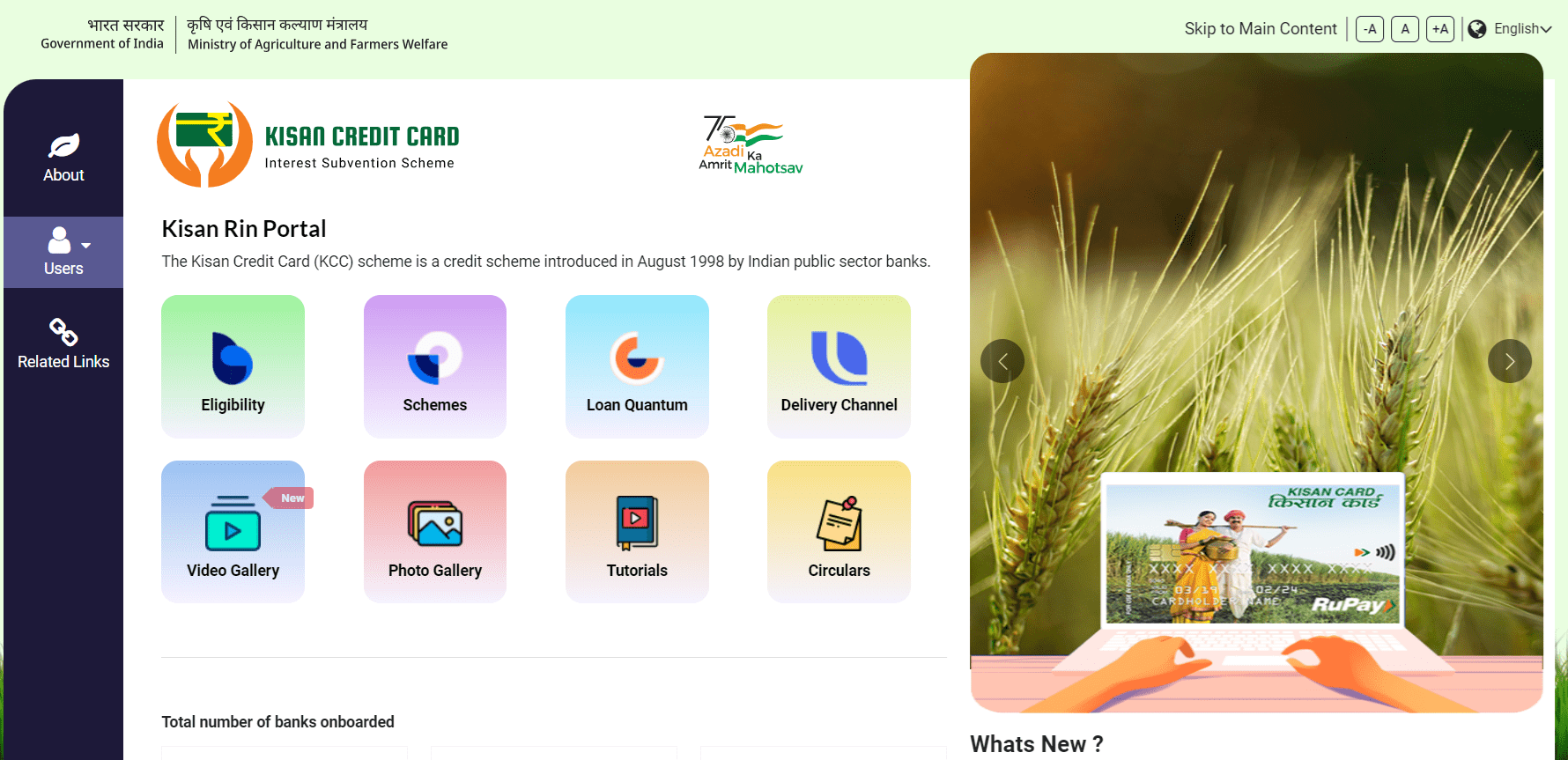

Kisan Rin Portal Login

Here is the process which you must follow to make fasalrin.gov.in portal login:-

STEP 1: First of all, visit Kisan Rin Portal at https://fasalrin.gov.in/

STEP 2: At the homepage, scroll over “Users” tab and click ‘Login‘ link or directly click https://fasalrin.gov.in/login

STEP 3: Then page to make Kisan Rin Portal login will open.

STEP 4: If any farmer is already registered with PM Fasal Bima Yojana (PMFBY), then kisan can use the same PMFBY ID and password.

STEP 5: Enter your mobile number, password, captcha code and click “Login” button to make fasalrin.gov.in portal login.

Know Your Schemes at fasalrin.gov.in Portal

- The Modified Interest Subvention Scheme (MISS) is available for banks under certain eligible sub-limits of KCC upto an overall KCC limit of Rs. 3.00 lakh to the following:

- Farmers, individuals/ Joint borrowers who are owner cultivator;

- Tenant farmers, oral lessees & share croppers;

- Self Help Groups (SHGs) or Joint Liability Group (JLG)sof farmers including share croppers etc.

- Farmers engaged in agriculture and allied activities like Animal Husbandry, Dairy, Fisheries, Bee keeping etc under the scheme, the lending institutions to make Aadhaar linkage mandatory for availing short term loan for such activities. It is mandatory to link all KCC accounts with Aadhaar for availing benefits under MISS except the exclusion criteria for the applicable States as notified by GoI from time to time.

- The overall limit for KCC loans are fixed based on the following sub-limits are eligible under the MISS subject to the maximum eligible sub-limits per farmer: –

- Short term credit requirements for cultivation of crops;

- Post-harvest expenses;

- Working Capital for activities allied to agriculture viz., animal husbandry, dairy, fisheries, Poultry, other Ruminants, Mushroom, Bee keeping and Sericulture etc.

- Produce marketing loan; Financing against e-NWR receipts;

- Quantum of Eligible Amount:

- For cultivation of crops & Post harvest expenses – Rs. 3 lakh

- For allied activities related to Animal husbandry, Dairy, Fisheries, Lac cultivation, Mulberry cultivation, Sericulture and Bee keeping etc. – Rs. 2 lakh

- The IS and PRI amounts are to be calculated on the loan amount from the date of disbursement/withdrawal up to the date of actual repayment of the loan by the farmer or up to the due date of the loan fixed by the banks, whichever is earlier, subject to a maximum period of one year.

- The PRI benefits would accrue to only those farmers, who repay their eligible loans on time.

KCC Modified Interest Subvention Scheme Eligibility Criteria

- Farmers – individual/joint borrowers who are owner cultivators;

- Tenant farmers, oral lessees & share croppers;To overcome the problem faced by the Financial Institutions (FIs) in lending to landless labourers, share cropper sand oral lessees due to the absence of documents verifying their identity and status;

- Self Help Groups (SHGs) or Joint Liability Groups (JLGs) of farmers including tenant farmers, share croppers etc.To provide credit to landless farmers cultivating land as tenant farmer, oral lessees or share croppers and small / marginal farmers as well as other poor individuals taking up farm/off farm activities;

- The Kisan Credit Card scheme aims at providing adequate and timely credit support from the banking system under a single window with flexible and simplified procedure to the farmers for their cultivation and other needs as indicated below:-

- To meet the short term credit requirements for cultivation of crops (including seasonal Horticultural vegetable crops and working capital need / requirements of medium/long duration crops such as Horticultural Fruits, Flowers, Plantation crops, Spices, Aromatic plants and medicinal plants)

- Post-harvest expenses; financing against e-NWR

- Produce marketing loan;

- Consumption requirements of farmer household;

- Working capital for maintenance of farm assets;

- Working capital for maintenance activities allied to agriculture Dairy, Fisheries, Poultry, other Ruminants, Mushroom,Bee keeping and Sericulture etc.

Know your KCC MISS eligibility through the link – https://fasalrin.gov.in/eligibility

Know Loan Quantum in KCC Interest Subvention Scheme

- The short term limit to be arrived for the first year (For cultivating single crop in a year): Scale of finance for the crop (as decided by District Level Technical Committee) x Extent of area cultivated + 10% of limit towards post- harvest/ household/ consumption requirements + 20% of limit towards repairs and maintenance expenses of farm assets + crop insurance and/or accident insurance including PAIS, health insurance & asset insurance.

- Limit for second & subsequent year: First year limit for crop cultivation purpose arrived at as above plus 10% of the limit towards cost escalation / increase in scale of finance for every successive year (2nd, 3rd, 4th and 5thyear) and estimated term loan component for the tenure of Kisan Credit Card, i.e., five years. (Illustration I).

- For cultivating more than one crop in a year: The limit is to be fixed as above depending upon the crops cultivated as per proposed cropping pattern for the first year plus an additional 10% of the limit towards cost escalation / increase in scale of finance for every successive year (2nd, 3rd, 4th and 5th year). It is assumed that the farmer adopts the same cropping pattern for the succeeding four years. In case the cropping pattern adopted by the farmer is changed in the subsequent year, the limit may be reworked.

- For cultivating more than one crop in a year: The term loan for investment is to be made towards land development, minor irrigation, purchase of farm equipment and allied agricultural activities. The banks may fix the quantum of credit for term and working capital limit for agricultural and allied activities, etc., based on the unit cost of the asset/s proposed to be acquired by the farmer, the allied activities already being undertaken on the farm, the bank’s judgment on repayment capacity vis-a-vis total loan burden devolving on the farmer, including existing loan obligations.

The term loan limit should be based on the proposed investment(s) during the five-year period and the bank’s perception on the repaying capacity of the farmer.Farmers with landholding of up to 1 hectare (Marginal Farmers). Farmers with a landholding of more than 1 hectare and up to 2 hectares (Small Farmers). - Maximum Permissible Limit: The short term loan limit arrived for the 5th year plus the estimated term loan requirement will be the Maximum Permissible Limit (MPL) and is to be treated as the Kisan Credit Card limit.

- Fixation of Sub-limits:

- Short term loans and term loans are governed by different interest rates. At present, short term crop loans up to ₹ 3 lakhs are covered under Interest Subvention Scheme/Prompt Repayment Incentive scheme of the Government of India1. Further, repayment schedule and norms are different for short term and term loans. Hence, in order to have operational and accounting convenience, the card limit is to be bifurcated into separate sub-limits for short term cash credit limit cum savings account and term loans.

- Drawing limit for short term cash credit should be fixed based on the cropping pattern. The amount(s) for crop production, repair and maintenance of farm assets and consumption may be allowed to be drawn as per the convenience of the farmer.

- In case the revision of scale of finance for any year by the district level technical committee exceeds the notional hike of 10% contemplated while fixing the five-year limit, a revised draw able limit may be fixed in consultation with the farmer. In case such revisions require the card limit itself to be enhanced (4th or 5th year), the same may be done and the farmer be so advised.

- For term loans, instalments may be allowed to be withdrawn based on the nature of investment and repayment schedule drawn as per the economic life of the proposed investments. It is to be ensured that at any point of time the total liability should be within the drawing limit of the concerned year.

- Wherever the card limit / liability so arrived warrants additional security, the banks may take suitable collateral as per their policy.

- Know your loan quantum – https://fasalrin.gov.in/loanQuantum

For Marginal Farmers: A flexible limit of ₹10,000 to ₹50,000 may be provided (as Flexi KCC) based on the land holding and crops grown including post-harvest warehouse storage related credit needs and other farm expenses, consumption needs, etc., plus small term loan investment(s) like purchase of farm equipment(s), establishing mini dairy/backyard poultry as per assessment of the Branch Manager without relating it to the value of land. The composite KCC limit is to be fixed for a period of five years on this basis.

Modified KCC Interest Subvention Scheme Benefits

- The benefit of MISS are available to banks only on their own funds involved for extending credit support up to Rs.3 lakh at 7% interest per annum.

- In order to discourage distress sale of produce by Small and Marginal farmers (SF/MF) having Kisan Credit Card, the benefits of IS is available for a period of up to six months, post the harvest of the crop against Negotiable Warehouse Receipts issued on the produce stored in warehouses accredited with Warehousing Development Regulatory Authority.

- In order to provide relief to farmers affected by natural calamities, IS may be available to banks for the first year on restructured amount of crop loans. Such restructured loans will attract normal rate of interest from the second year onwards as per the extant policy laid down by RBI.

Eligible lending institutions for KCC MISS

- Public Sector Banks (PSBs),

- Private Sector Scheduled commercial Banks,

- Small Finance Banks (SFBs),

- Computerized Primary Agricultural Credit Societies (PACS) ceded with Scheduled Commercial Banks (SCBs),

- Regional Rural Banks (RRBs)

- Rural Cooperative Banks (RCBs) viz. State Cooperative Banks & District Central Cooperative Banks (DCCBs)

Finance Minister on fasalrin.gov.in Portal Launch

Finance Minister asked banks to give all relevant data by December 31, 2024 for PM Kisan Rin Portal. At the launch of the new fasalrin.gov.in portal, Smt. Nirmala Sitharaman expressed her concern over the slow progress of computerisation in Regional Rural Banks (RRBs). She also urged RRB management to ramp up the process to strengthen credit delivery in rural areas.

There is still a lot of work to do in digitising RRBs and cooperative banks, she said after launching the ‘Kisan Rin Portal’ and Weather Information Network Data Systems (WINDS) manual in New Delhi. Cooperative banks are not equally endowed, and their financial health varies, she said, adding ramping up capacity in the sector is taking place under the Ministry of Cooperation headed by Home Minister Amit Shah.

The cooperative bank digitisation would happen with the necessary speed, she said. However, she said, “I am more concerned about RRBs, their digitisation and computerisation. Therefore, if they didn’t have it, extending phone bank facility…or internet banking facility…won’t work out”. She also highlighted that a lot of work is pending, and the Department of Financial Services is sensitising them to achieve computerisation at a fast pace.

Finance Minister was also surprised by the huge gap between sanction of funds and their disbursement by cooperative banks. She also asked officials to find out the reason for the wide gap between sanctions and disbursement. However, the difference between sanction and disbursement is low in the case of scheduled commercial banks.

References

- Delivery Channel Information for disbursement – https://fasalrin.gov.in/disbursement

- Circulars – https://fasalrin.gov.in/circulars

- About Kisan Schemes – https://fasalrin.gov.in/about

For more details, check the Kisan Rin Portal FAQ’s – https://fasalrin.gov.in/faq