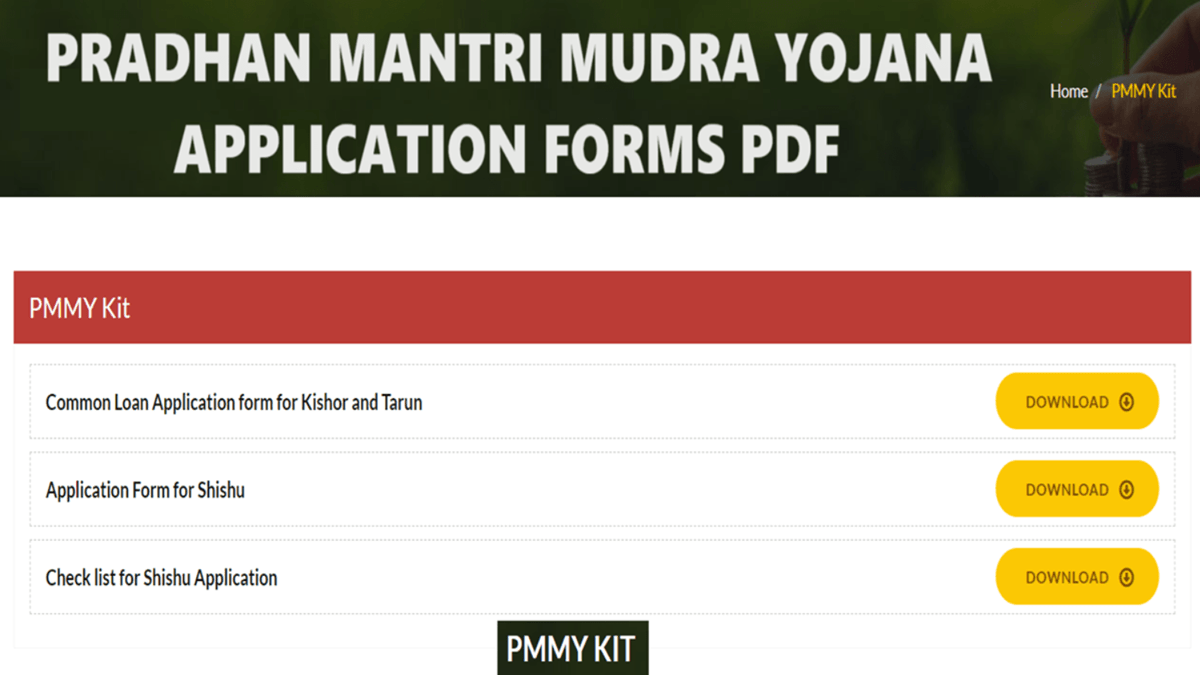

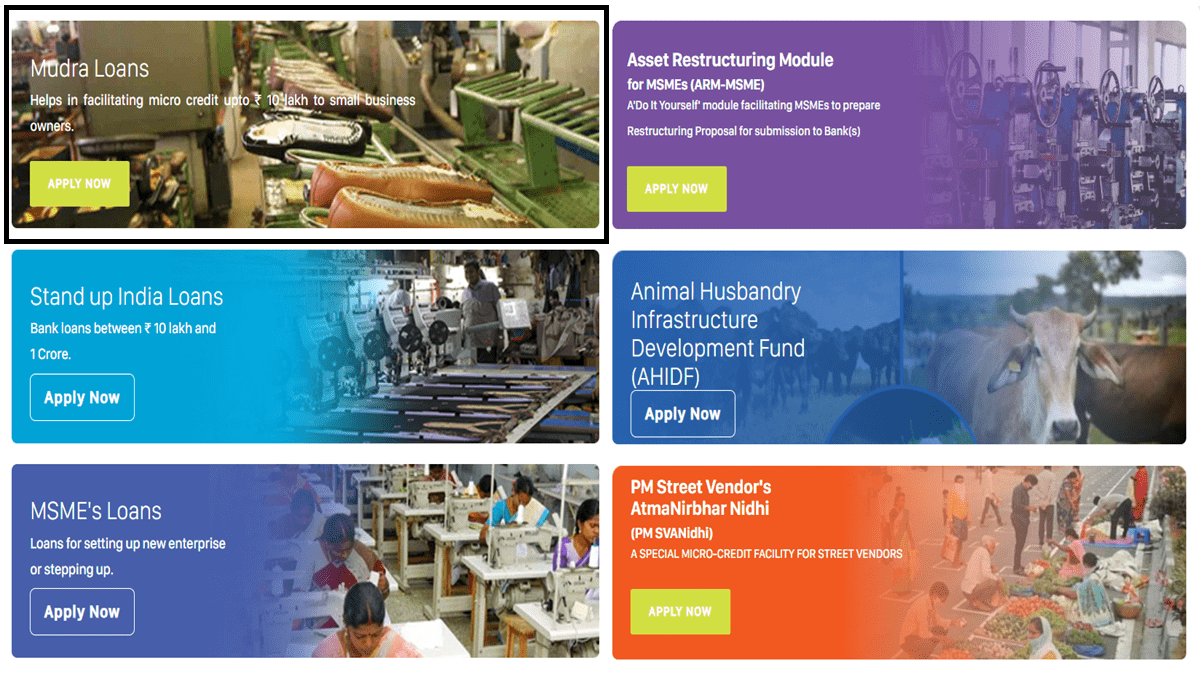

PM Kisan Credit Card apply online process begins, apply for new KCC & if already applied, track application status. Kisan Credit Card Scheme Application Form PDF also available which you can download from pmkisan.gov.in. Central government has launched a campaign for saturation of all PM Kisan beneficiaries with Kisan Credit Card Yojana. This scheme aims to provide timely and adequate credit to farmers. It would enable farmers to meet their production credit needs (cultivation expenses). Besides, KCC would facilitate farmers to meet contingency expenses and expenses related to ancillary activities through simplified procedure facilitating the borrowers for availing loans as and when they need.

Farmers can now download Loan Application Form for Agricultural Credit for PM Kisan beneficiaries in PDF format. The Kisan Credit Card Apply Online Form is now available at the official Pradhan Mantri Kisan Samman Nidhi Yojana portal. As per official notification, govt. has started drive to saturate all eligible farmers under KCC in India. For this purpose, Indian Banks Association has waived off charges like processing, documentation, inspection & ledger folio charges as well as service charges for KCC loans upto Rs. 3 lakh.

All the PM Kisan farmers can now approach their bank branches and submit the single page KCC registration form along with land record details & details of crops sown to get Kisan Credit Cards. Read this article till the end to know how to apply online for Kisan Credit Card Yojana, track status, what is the eligibility criteria, loan amount, list of documents required and other aspects regarding KCC scheme.

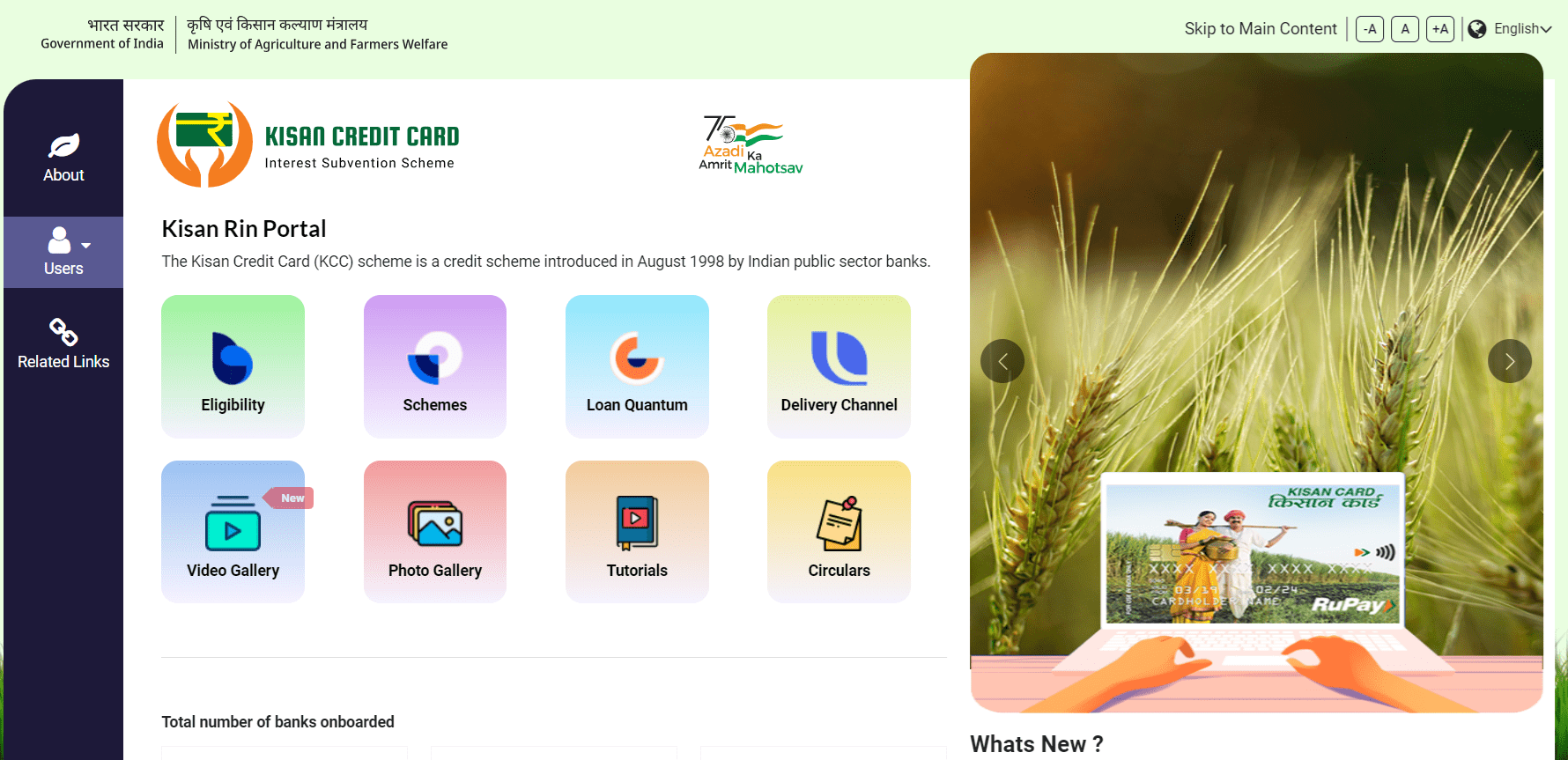

PM Kisan Credit Card Apply Online Process

- Farmers can visit the official PM Kisan Samman Nidhi Yojana Portal at https://www.pmkisan.gov.in/

- At the homepage, click at the “Download KCC Form” tab.

- Accordingly, the “Loan Application Form for Agricultural credit for PM-Kisan beneficiaries” will appear online.

- The direct link for downloading KCC Application Form PDF is given here – https://www.pmkisan.gov.in/Documents/Kcc.pdf

- The PM Kisan Credit Card Application Form PDF will appear as shown below:-

- Applicants will have to take a printout of the downloaded PM Kisan Credit Card Scheme apply online form.

- After filling in all the necessary details accurately, farmers can submit it with the concerned authorities.

All the banks have been directed to issue Kisan Credit Cards to farmers within 14 days of receiving KCC Application Form from PM-KISAN beneficiaries. If you are eligible to get a Kisan credit card, your bank will get back to you for the further process within 3-4 working days. Once your application has been processed, you will get the Kisan credit card in 14 days.

Apply New KCC – https://eseva.csccloud.in/KCC/Validate.aspx

Kisan Credit Card Yojana Eligibility Criteria

- All farmers-individuals/Joint borrowers who are owner cultivators.

- Tenant farmers, Oral lessees and Share croppers, etc,.

- SHGs or Joint Liability Groups of farmers including tenant farmers, share croppers, etc,.

Your minimum age should be 18 years and the maximum age is 75 years. If you are a senior citizen (over the age of 60), you need a co-borrower who has to be your legal heir.

List of Documents Required for KCC Scheme

- Application Form.

- Two Passport Size Photographs.

- ID proof such as Driving License / Aadhar Card / Voter Identity Card / Passport, etc,. Any one document needs to be submitted.

- Address Proof such as Driving License, Aadhar Card, etc,.

- Proof of landholding duly certified by the revenue authorities.

- Cropping pattern (Crops grown) with acreage.

- Security documents for loan limit above Rs. 1.60 lakhs / Rs. 3 lakhs, as applicable.

- Any other document as per sanction.

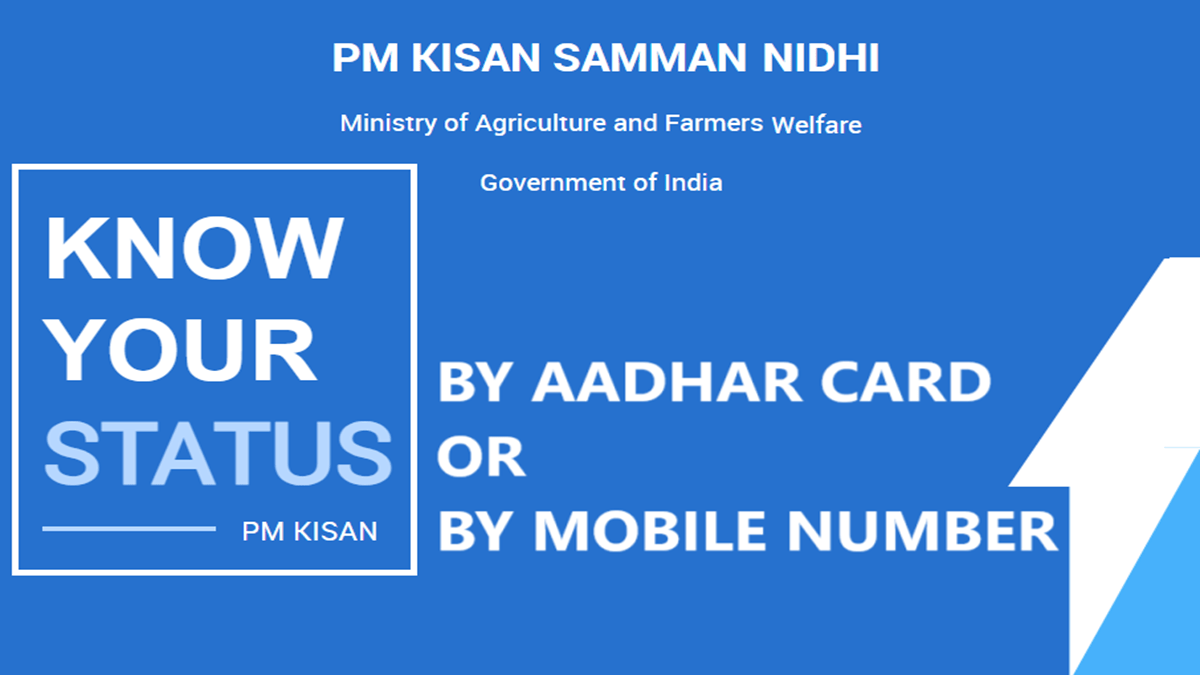

Check Kisan Credit Card Status through CSC

How to Check Your Credit Card Application via Kisan Credit Card Website:-

Step 1: Go to the CSC PM KCC Portal, by visiting the website, to https://eseva.csccloud.in/KCC/Default.aspx

Step 2: Now, log into the portal using your CSC ID and the password.

Step 3: Select “View Status” link or directly click https://eseva.csccloud.in/kcc/trackstatus.html

Step 4: You will be redirected to a new page you need to enter your Kisan credit card application ID.

Step 5: Now, you will be able to see the PM KCC Application Status will come in front of you.

Keep in mind that you can track the status of your credit card application only after 6 to 7 days of having applied for the card.

KCC Scheme Loan Amount / Interest Rate

- Up to Rs. 3 lakhs- 7% p.a. subject to GoI providing interest subvention. For interest subvention, submission of Aadhar details to Bank is mandatory (wherever applicable).

- Above Rs. 3 lakhs- as applicable from time to time

Yes, you can increase the limit of your Kisan credit card and you need to submit the required documents to the bank to do the same.

Processing Fee for Kisan Credit Card Scheme

- KCC Limits up to Rs. 3 lakhs: NIL

- Limits more than Rs. 3 lakhs: 0.35% of loan limit + GS

It is subject to change from time to time.

PM Kisan Credit Card Benefits

- Type of Facility: Revolving cash credit account. Credit balance in the account, if any, will fetch interest at Savings bank rate.

- Quantum of Loan: Need Based finance considering cropping pattern, acreage and Scale of Finance (SOF) determined by DLTC (District Level Technical Committee).

- Margin: Nil

- Moratorium: NA

- Repayment: The repayment period as per the crop period (Short/ Long) and marketing period for the crop.

- Security:

- Primary: Hypothecation of Crops grown / assets to be created out of Bank finance.

- Collateral: Equitable mortgage / registered mortgage of land / immovable property as applicable of the value of 100 % loan. However, collateral is waived for KCC limit up to Rs. 1.60 lakh and up to Rs. 3 lakhs, in case of tie up arrangement.

- Interest Subvention: 3% p.a. interest subvention as Prompt Repayment Incentive (PRI) up to Rs. 3 lakhs.

- Tenure: 5 years, with 10% annual increase of limit every year, subject to annual review.

- Rupay debit cards for all eligible KCC borrowers.

- Insurance:

- Eligible crops may be covered under PRADHAN MANTRI FASAL BIMA YOJNA (PMFBY) on premium payment.

- Borrower should also opt for Personal Accident Insurance, Health Insurance (wherever applicable).

Kisan Credit Card Helpline Number

You can call the toll-free number, 155261 / 1800115526 or reach 0120-6025109 to raise any concerns regarding the Kisan Credit Card scheme. If you wish to send a mail to the Kisan Credit Card customer care, you can write to pmkisan-ict@gov.in

Download Kisan Credit Card Notification PDF – https://pmkisan.gov.in/Documents/finalKCCCircular.pdf

![List of Top 25 Agricultural Schemes in India [y] for Welfare of Farmers List of Top 25 Agricultural Schemes in India](https://hindustanyojana.in/wp-content/uploads/2024/08/list-of-top-25-agricultural-schemes-in-india.png)

![PM Kisan Farmer Registration Form [y], e-KYC at pmkisan.gov.in PM Kisan Farmer Registration Form](https://hindustanyojana.in/wp-content/uploads/2024/09/pm-kisan-farmer-registration-form.png)

![PSB Loans in 59 Minutes Registration [y] & Login - Apply Online for Home, Auto, Personal Loans Apply Online PSB Loans in 59 Minutes](https://hindustanyojana.in/wp-content/uploads/2024/08/apply-online-psb-loans-in-59-minutes.png)