E Panjiyan Rajasthan DLC Rate Information now available online at epanjiyan.rajasthan.gov.in, check district level committee rates for any immovable property. You can now check DLC rates in Rajasthan state for any residential, commercial, interior, exterior, institutional and industrial property. DLC rate is the minimum rate at which stamp duty and registration fees are calculated. Read this article till the end to know how to check epanjiyan Rajasthan DLC rate info. in a district wise manner.

E Panjiyan Rajasthan DLC Rate Information

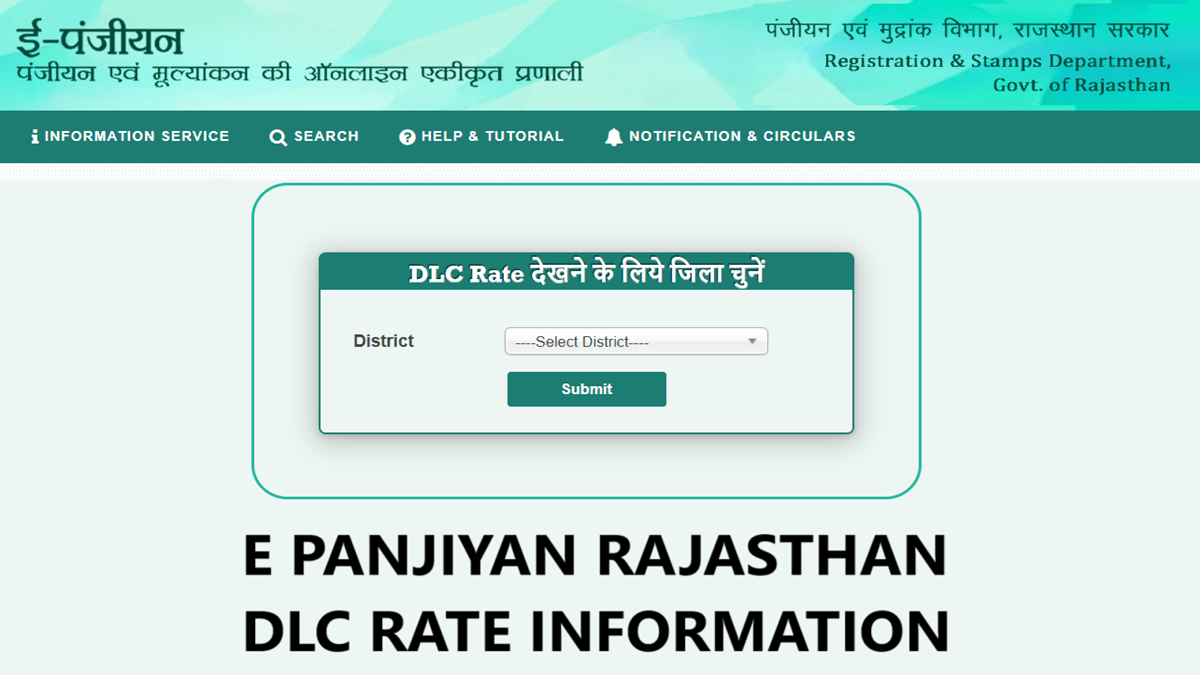

STEP 1: Firstly visit the E Panjiyan Rajasthan official website at https://epanjiyan.rajasthan.gov.in/

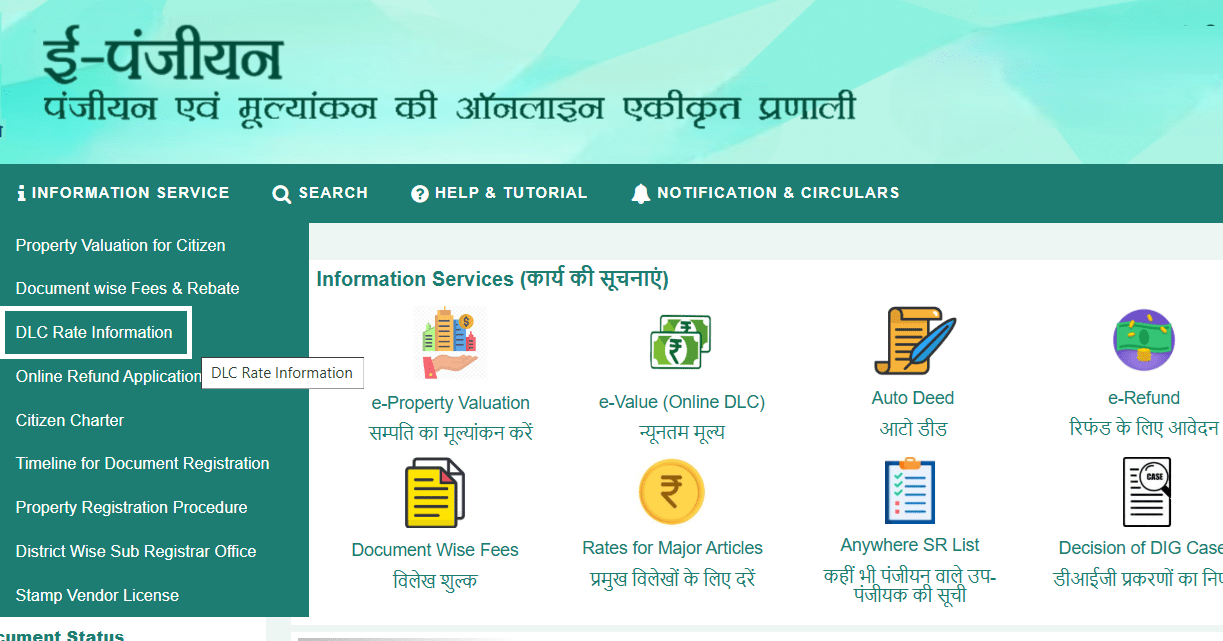

STEP 2: At the homepage, scroll over ‘Information Service’ tab present in the main menu and click at “DLC Rate Information” link.

STEP 3: Direct link – https://epanjiyan.rajasthan.gov.in/dlcdistrict.aspx

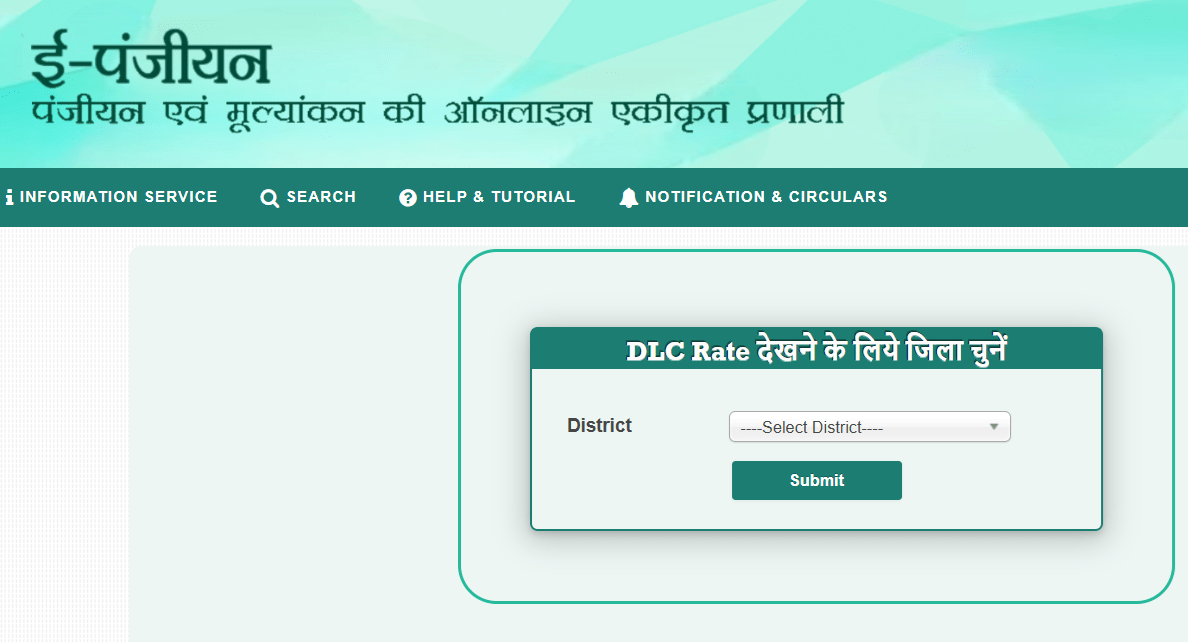

STEP 4: Upon clicking the link, the DLC Rate Information (district wise) checking page will open.

STEP 5: Select the name of district and click “Submit” button. For eg- we have selected “Ajmer” district.

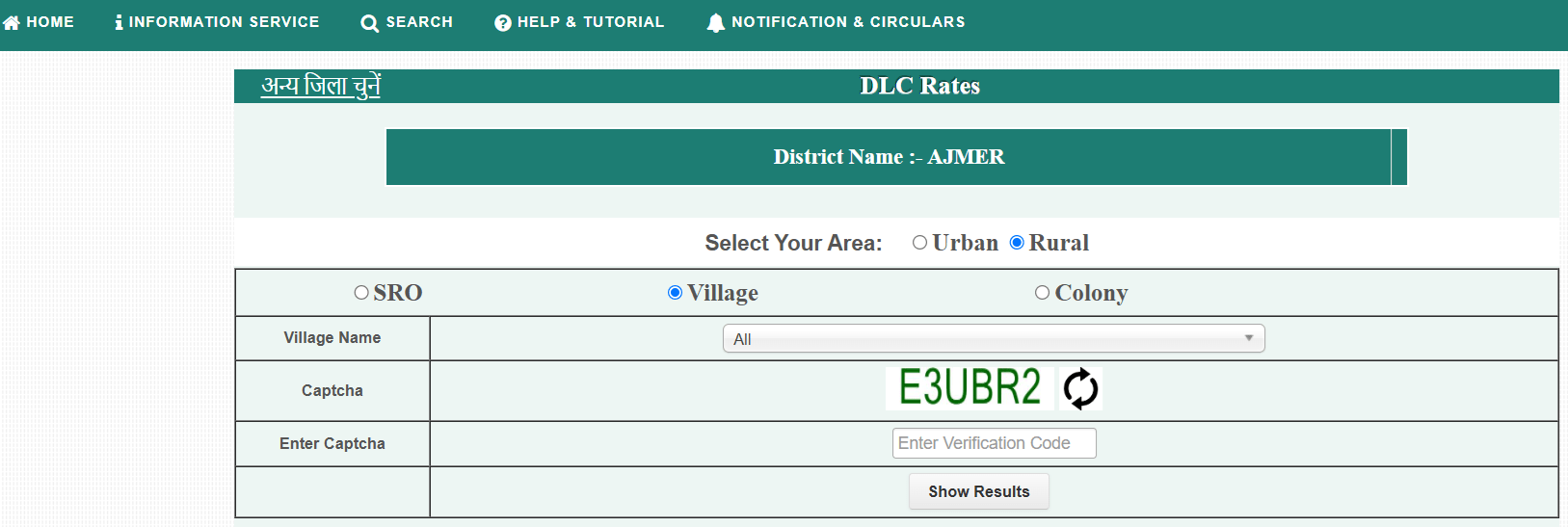

STEP 6: Select your area as either urban (SRO, Zone, Colony) or rural (SRO, Village, Colony). For eg- we have selected area as “Rural” and then “Village” option.

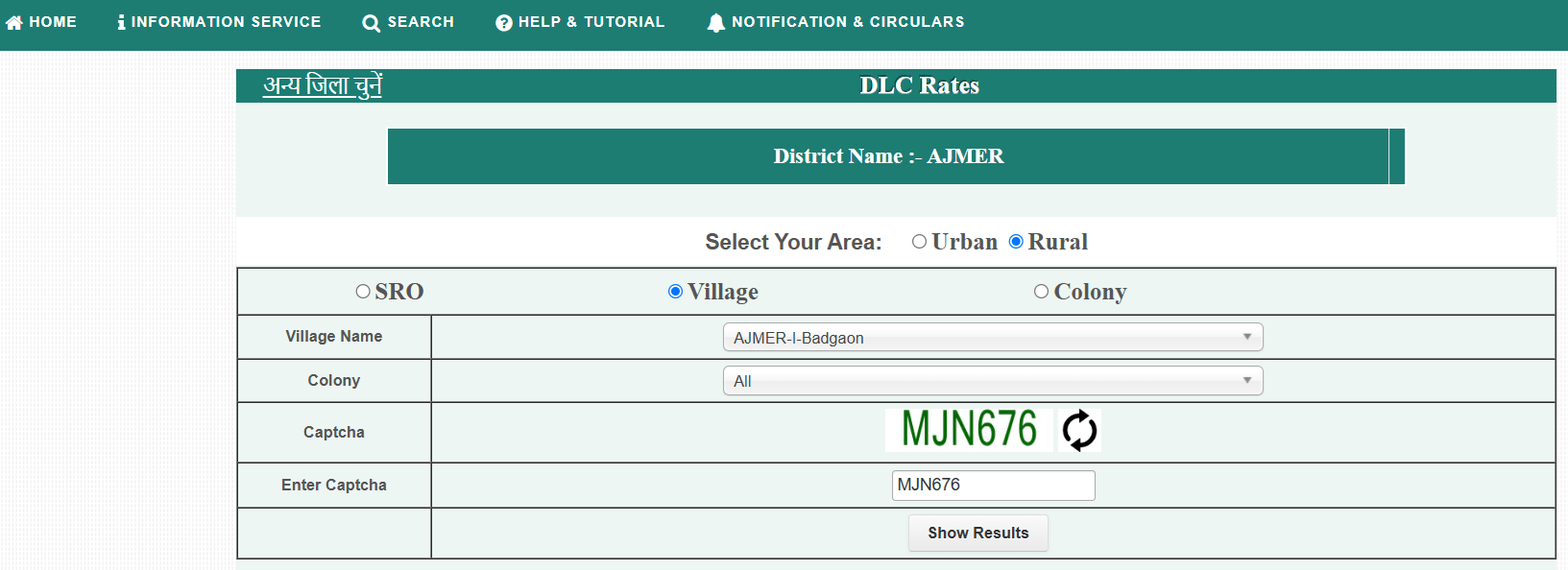

STEP 7: Next select “Village Name“, “Colony“, then enter captcha and click at “Show Results” button. For eg- we have selected village name as ‘AJMER-I-Badgaon’, colony as ‘All’, entered captcha and clicked at ‘Show Results’ button.

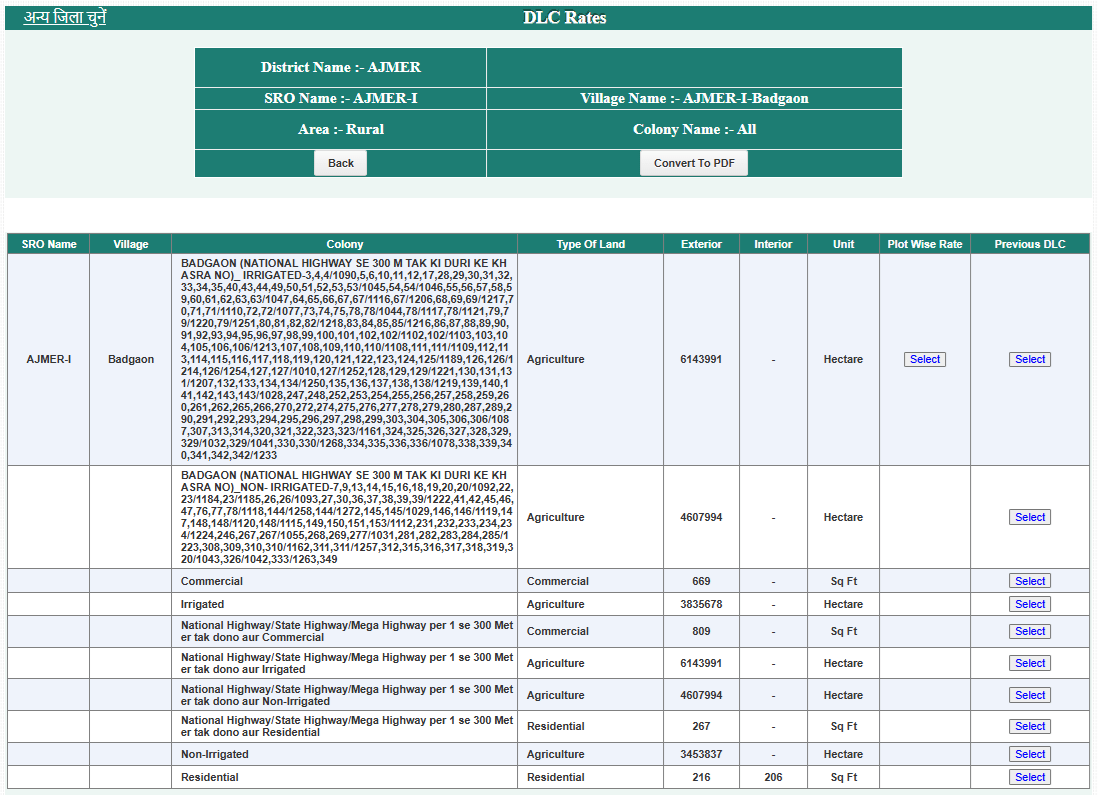

STEP 8: Then the page to find DLC rate at epanjiyan Rajasthan portal will open.

STEP 9: Here you can check e Panjiyan Rajasthan DLC rates with name of village, colony, type of land, exterior rates, interior rates, unit, plot wise rate as well as previous DLC.

DLC Rate Calculator for Any Property in Rajasthan

The DLC rate is an important parameter used to calculate the stamp duty and registration charges during property transactions. It is periodically reviewed and updated by Rajasthan government to reflect current market conditions. Suppose the DLC rate of Jaipur is 80 lakh. And with a stamp duty rate of 5%, you have to pay 4 lakh. If the property valuation becomes 90 lakh, you would have to pay a stamp duty of 4.5 lakh. But if the property valuation becomes 70 lakh, you still have to pay 4 lakh as stamp duty as that is the lowest rate.

Example of the DLC rate in Rajasthan?

2 rates are concerned while doing the registration and stamp duty i.e the market rate and the DLC rate. District Level Committee or DLC rate is the minimum value at which the official paper work is done in Rajasthan state. Property Registration cannot be done below DLC rate. Now we will try to explain DLC rates by examples.

Ex 1 – DLC rate is higher than the market rate

Suppose DLC Rate of Property – Rs. 7500 per sq.ft

Market Value of Property – Rs. 7000 per sq.ft

In this case, the registration and the stamp duty charges will be calculated on the DLC rate i.e Rs. 7500 per sq.ft because DLC rate is higher here.

Ex 2 – Market rate is higher than DLC rate

Suppose DLC Rate of Property – Rs. 7000 per sq.ft

Market Value of Property- Rs. 7500 per sq.ft

In this case, the registration and the stamp duty will be performed on the market rate i.e Rs. 7500 per sq.ft because market rate is higher here.

From both the examples, it is confirmed that registering any property below the DLC rate is not possible.

Other Names For DLC Rate in India

DLC rate is a term largely used in Rajasthan. DLC rates may vary across localities, cities, and states, and it has a different name in different states. Here is a list of the various terms used across India.

| Market Value Guideline | Chhattisgarh, MP |

| Guidance Value | Karnataka |

| Guideline Value | Tamil Nadu |

| BenchMark Valuation | Odisha |

| Ready Reckoner Rate | Maharashtra |

| Circle Rate | Delhi, UP, Uttarakhand |

| Collector Rate | Haryana, Punjab |

| Unit Rate | Telangana |

For more details on e Panjiyan Rajasthan DLC rate information, visit the official website epanjiyan.rajasthan.gov.in

![RGHS Rajasthan Hospital List & Pharmacy List [y] PDF Download RGHS Rajasthan Hospital List / Pharmacy List](https://hindustanyojana.in/wp-content/uploads/2024/10/rghs-rajasthan-hospital-list-pharmacy-list.png)

![Mukhyamantri Kisan Samman Nidhi Yojana Rajasthan [y] Payment Status Check Online CM Kisan Samman Nidhi Yojana Rajasthan Status Check](https://hindustanyojana.in/wp-content/uploads/2024/10/cm-kisan-samman-nidhi-yojana-rajasthan-status-check.png)

![Rajasthan Mukhyamantri B.Ed. Sambal Yojana [y] Apply Online, Last Date Rajasthan CM B.Ed Sambal Yojana Apply Online, Last Date Extended 2024-25](https://hindustanyojana.in/wp-content/uploads/2024/10/rajasthan-cm-bed-sambal-yojana-apply-online-last-date-extended-2024-25.png)

![Rajasthan Ration Card List [y] (District Wise), Status Check at food.rajasthan.gov.in Rajasthan Ration Card List, Status](https://hindustanyojana.in/wp-content/uploads/2024/12/rajasthan-ration-card-list-status.png)

![Rajasthan Government Health Scheme Registration Form [y] at rghs.rajasthan.gov.in Rajasthan Government Health Scheme Registration Form Online](https://hindustanyojana.in/wp-content/uploads/2024/10/rajasthan-government-health-scheme-registration-form-online.png)