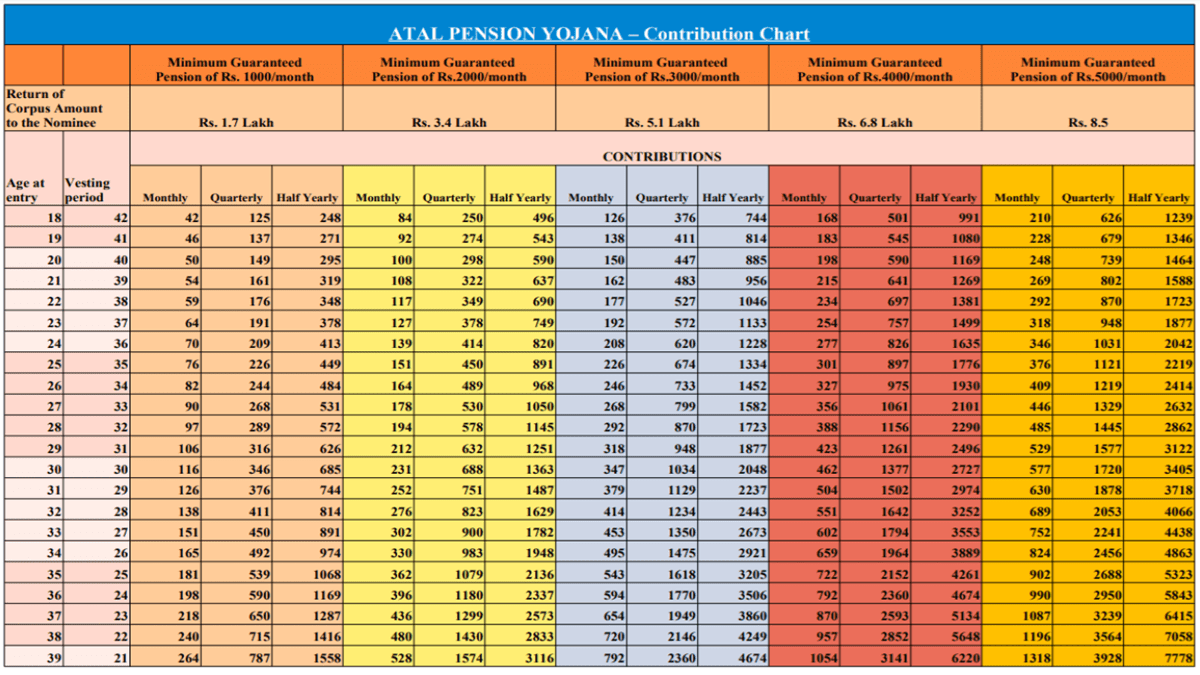

Atal Pension Yojana Chart PDF with age at entry, vesting period, monthly contribution, quarterly contribution and half yearly contribution can now be checked online. Download APY Chart 2024 PDF for different minimum guaranteed monthly pensions of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000 and Rs. 5000 offered by central government. These pensions correspond to return of corpus amount of Rs. 1.7 lakh, Rs. 3.4 lakh, Rs. 5.1 lakh, Rs. 6.8 lakh and Rs. 8.5 lakh respectively. Read this article till the end to check how much amount you will have to contribute and for how much time to get different monthly pensions.

Also Read: Atal Pension Yojana Forms PDF Download

Atal Pension Yojana Chart PDF

You can now view APY chart for the following:-

- Minimum Guaranteed of Rs. 1000 per month – Return of Corpus Amount of Rs. 1.7 lakh to the Nominee

- Minimum Guaranteed of Rs. 2000 per month – Return of Corpus Amount of Rs. 3.4 lakh to the Nominee

- Minimum Guaranteed of Rs. 3000 per month – Return of Corpus Amount of Rs. 5.1 lakh to the Nominee

- Minimum Guaranteed of Rs. 4000 per month – Return of Corpus Amount of Rs. 6.8 lakh to the Nominee

- Minimum Guaranteed of Rs. 5000 per month – Return of Corpus Amount of Rs. 8.5 lakh to the Nominee

APY Chart for Min Guaranteed Rs. 1000 Monthly Pension

| Age at Entry | Vesting Period | Monthly Contribution | Quarterly Contribution | Half Yearly Contribution |

|---|---|---|---|---|

| 18 | 42 | 42 | 125 | 248 |

| 19 | 41 | 46 | 137 | 271 |

| 20 | 40 | 50 | 149 | 295 |

| 21 | 39 | 54 | 161 | 319 |

| 22 | 38 | 59 | 176 | 348 |

| 23 | 37 | 64 | 191 | 378 |

| 24 | 36 | 70 | 209 | 413 |

| 25 | 35 | 76 | 226 | 449 |

| 26 | 34 | 82 | 244 | 484 |

| 27 | 33 | 90 | 268 | 531 |

| 28 | 32 | 97 | 289 | 572 |

| 29 | 31 | 106 | 316 | 626 |

| 30 | 30 | 116 | 346 | 685 |

| 31 | 29 | 126 | 376 | 744 |

| 32 | 28 | 138 | 411 | 814 |

| 33 | 27 | 151 | 450 | 891 |

| 34 | 26 | 165 | 492 | 974 |

| 35 | 25 | 181 | 539 | 1068 |

| 36 | 24 | 198 | 590 | 1169 |

| 37 | 23 | 218 | 650 | 1287 |

| 38 | 22 | 240 | 715 | 1416 |

| 39 | 21 | 264 | 787 | 1558 |

APY Chart for Min Guaranteed Rs. 2000 Monthly Pension

| Age at Entry | Vesting Period | Monthly Contribution | Quarterly Contribution | Half Yearly Contribution |

|---|---|---|---|---|

| 18 | 42 | 84 | 250 | 496 |

| 19 | 41 | 92 | 274 | 543 |

| 20 | 40 | 100 | 298 | 590 |

| 21 | 39 | 108 | 322 | 637 |

| 22 | 38 | 117 | 349 | 690 |

| 23 | 37 | 127 | 378 | 749 |

| 24 | 36 | 139 | 414 | 820 |

| 25 | 35 | 151 | 450 | 891 |

| 26 | 34 | 164 | 489 | 968 |

| 27 | 33 | 178 | 530 | 1050 |

| 28 | 32 | 194 | 578 | 1145 |

| 29 | 31 | 212 | 632 | 1251 |

| 30 | 30 | 231 | 688 | 1363 |

| 31 | 29 | 252 | 751 | 1487 |

| 32 | 28 | 276 | 823 | 1629 |

| 33 | 27 | 302 | 900 | 1782 |

| 34 | 26 | 330 | 983 | 1948 |

| 35 | 25 | 362 | 1079 | 2136 |

| 36 | 24 | 396 | 1180 | 2337 |

| 37 | 23 | 436 | 1299 | 2573 |

| 38 | 22 | 480 | 1430 | 2833 |

| 39 | 21 | 528 | 1574 | 3116 |

APY Chart for Min Guaranteed Rs. 3000 Monthly Pension

| Age at Entry | Vesting Period | Monthly Contribution | Quarterly Contribution | Half Yearly Contribution |

|---|---|---|---|---|

| 18 | 42 | 126 | 376 | 744 |

| 19 | 41 | 138 | 411 | 814 |

| 20 | 40 | 150 | 447 | 885 |

| 21 | 39 | 162 | 483 | 956 |

| 22 | 38 | 177 | 527 | 1046 |

| 23 | 37 | 192 | 572 | 1133 |

| 24 | 36 | 208 | 620 | 1228 |

| 25 | 35 | 226 | 674 | 1334 |

| 26 | 34 | 246 | 733 | 1452 |

| 27 | 33 | 268 | 799 | 1582 |

| 28 | 32 | 292 | 870 | 1723 |

| 29 | 31 | 318 | 948 | 1877 |

| 30 | 30 | 347 | 1034 | 2048 |

| 31 | 29 | 379 | 1129 | 2237 |

| 32 | 28 | 414 | 1234 | 2443 |

| 33 | 27 | 453 | 1350 | 2673 |

| 34 | 26 | 495 | 1475 | 2921 |

| 35 | 25 | 543 | 1618 | 3205 |

| 36 | 24 | 594 | 1770 | 3506 |

| 37 | 23 | 654 | 1949 | 3860 |

| 38 | 22 | 720 | 2146 | 4249 |

| 39 | 21 | 792 | 2360 | 4674 |

APY Chart for Min Guaranteed Rs. 4000 Monthly Pension

| Age at Entry | Vesting Period | Monthly Contribution | Quarterly Contribution | Half Yearly Contribution |

|---|---|---|---|---|

| 18 | 42 | 168 | 501 | 991 |

| 19 | 41 | 183 | 545 | 1080 |

| 20 | 40 | 198 | 590 | 1169 |

| 21 | 39 | 215 | 641 | 1269 |

| 22 | 38 | 234 | 697 | 1381 |

| 23 | 37 | 254 | 757 | 1499 |

| 24 | 36 | 277 | 826 | 1635 |

| 25 | 35 | 301 | 897 | 1776 |

| 26 | 34 | 327 | 975 | 1930 |

| 27 | 33 | 356 | 1061 | 2101 |

| 28 | 32 | 388 | 1156 | 2290 |

| 29 | 31 | 423 | 1261 | 2496 |

| 30 | 30 | 462 | 1377 | 2727 |

| 31 | 29 | 504 | 1502 | 2974 |

| 32 | 28 | 551 | 1642 | 3252 |

| 33 | 27 | 602 | 1794 | 3553 |

| 34 | 26 | 659 | 1964 | 3889 |

| 35 | 25 | 722 | 2152 | 4261 |

| 36 | 24 | 792 | 2360 | 4674 |

| 37 | 23 | 870 | 2593 | 5134 |

| 38 | 22 | 957 | 2852 | 5648 |

| 39 | 21 | 1054 | 3141 | 6220 |

APY Chart for Min Guaranteed Rs. 5000 Monthly Pension

| Age at Entry | Vesting Period | Monthly Contribution | Quarterly Contribution | Half Yearly Contribution |

|---|---|---|---|---|

| 18 | 42 | 210 | 626 | 1239 |

| 19 | 41 | 228 | 679 | 1346 |

| 20 | 40 | 248 | 739 | 1464 |

| 21 | 39 | 269 | 802 | 1588 |

| 22 | 38 | 292 | 870 | 1723 |

| 23 | 37 | 318 | 948 | 1877 |

| 24 | 36 | 346 | 1031 | 2042 |

| 25 | 35 | 376 | 1121 | 2219 |

| 26 | 34 | 409 | 1219 | 2414 |

| 27 | 33 | 446 | 1329 | 2632 |

| 28 | 32 | 485 | 1445 | 2862 |

| 29 | 31 | 529 | 1577 | 3122 |

| 30 | 30 | 577 | 1720 | 3405 |

| 31 | 29 | 630 | 1878 | 3718 |

| 32 | 28 | 689 | 2053 | 4066 |

| 33 | 27 | 752 | 2241 | 4438 |

| 34 | 26 | 824 | 2456 | 4863 |

| 35 | 25 | 902 | 2688 | 5323 |

| 36 | 24 | 990 | 2950 | 5843 |

| 37 | 23 | 1087 | 3239 | 6415 |

| 38 | 22 | 1196 | 3564 | 7058 |

| 39 | 21 | 1318 | 3928 | 7778 |

Also Read: APY e-PRAN / Transaction Statement View

Download Atal Pension Yojana Chart PDF – https://www.npscra.nsdl.co.in/nsdl/scheme-details/APY_Subscribers_Contribution_Chart_1.pdf

APY Scheme Details PDF – https://www.npscra.nsdl.co.in/nsdl/scheme-details/APY%20Notification-%20Oct16,%202015.pdf

Also Read: Atal Pension Yojana Apply Online Form

Note:- A subscriber can join APY scheme on attaining the minimum age of 18 years and can make contributions for 42 years i.e till the age of 60 years. If the applicant joins at the age of 39 years, then he/she will have to make contribution for another 21 years. Each subscriber will have to make contribution for more than 20 years and after which, APY subscribers will start getting monthly pension on attaining the age of 60 years.