APY e-PRAN / Transaction Statement View facility available at npscra.nsdl.co.in, search with PRAN or without PRAN. Atal Pension Yojana (APY) is a central government backed pension scheme in India designed to provide a regular income to individuals in their retirement years. Launched in June 2015, it primarily targets workers in the unorganized sector who may not have access to formal pension plans. Read this article till the end to know how to view APY ePRAN and Master Details, APY Swavalamban Statement and NPS Lite e-PRAN through official website.

Also Read: Atal Pension Yojana Form PDF Download

APY e-PRAN / Transaction Statement View

- First of all, visit the official link https://www.npscra.nsdl.co.in/scheme-details.php

- At the opened page, click at “APY e-PRAN / Transaction Statement View” tab.

- Direct link – https://apy.nps-proteantech.in/CRAlite/EPranAPYOnloadAction.do

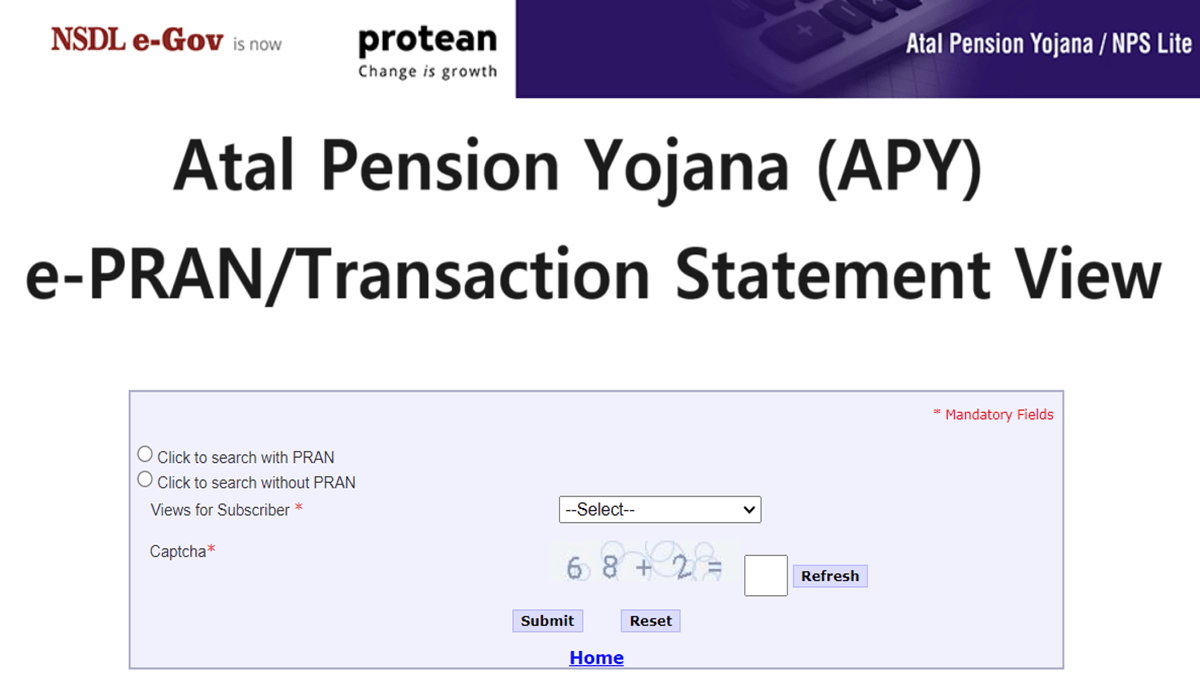

- Accordingly, the page for APY e-PRAN/Transaction Statement View will appear as shown below:-

- Select one of the 2 options – a) Click to search with PRAN b) Click to search without PRAN

- If you want to view APY transaction statement with PRAN, then select “a) Click to search with PRAN” option.

- Enter PRAN, Bank Account number, select views for subscriber (1- APY ePRAN and Master Details view, 2- APY Swavalamban Statement View, 3- NPS Lite e-PRAN View) and click “Submit” button to view APY transaction statement with PRAN.

- If you want to view APY transaction statement without PRAN, then select “b) Click to search without PRAN” option.

- Enter subscriber name, bank account no., date of birth, select views for subscribers (1- APY ePRAN and Master Details view, 2- APY Swavalamban Statement View, 3- NPS Lite e-PRAN View) and click “Submit” button to view APY transaction statement without PRAN.

Salient Features of Atal Pension Yojana 2024

The most striking features of APY scheme are as follows:-

- Eligibility:

- Should be an Indian citizen

- Age of the applicant must lie between 18 to 40 years

- Applicant must have a valid mobile number and savings bank account linked with Aadhaar.

- Contribution: The amount you contribute depends on the pension amount you want to receive after retirement. The government has a fixed contribution table based on the age of entry into the scheme. Check Atal Pension Yojana Chart PDF before applying for APY scheme.

- Pension Amount: Upon reaching the age of 60, you can receive a guaranteed monthly pension of Rs. 1,000 to Rs. 5,000, depending on your contributions and the plan you choose.

- Tax Benefits: Contributions to APY qualify for tax benefits under Section 80C of the Income Tax Act.

- Withdrawal: The scheme is designed for pension purposes, so premature withdrawals are not allowed. However, in the case of death of the subscriber, the nominee can receive the accumulated corpus.

Also Read: How to Apply Online for Atal Pension Yojana

Check Enrollment Details of APY Scheme – https://www.npscra.nsdl.co.in/enrollment-details-of-apy.php

Overall, the Atal Pension Yojana aims to enhance financial security for individuals in their retirement years, particularly for those who might otherwise lack sufficient savings or pension coverage.