NPS Traders Scheme apply online process begins at maandhan.in, make self enrollment using mobile number and OTP. This scheme is alternately known as National Pension Scheme for Traders and Self Employed Persons or PM Laghu Vyapari Mandhan Yojana. This is a central govt. scheme meant for old age protection and social security of traders and self employed persons. NPS-Traders is a voluntary and contributory pension scheme for small shopkeepers with monthly contribution ranging from Rs. 55 to Rs. 200 (depending on entry age).

Under NPS Traders and Self Employed Scheme, each beneficiary is entitled to receive a minimum assured pension of Rs. 3000/- per month after attaining the age of 60 years. The pension amount helps pension holders to aid their financial requirements. Traders and Self employed persons between the age group of 18 to 40 years will have to make monthly contributions till they attain the age of 60. Once the applicant attains the age of 60, he/ she can claim the pension amount.

Every month a fixed pension amount gets deposited in the pension account of the respective individual. Read this article till the end to know how to fill PM Laghu Vyapari Mandhan Yojana online registration form through official website.

NPS Traders Scheme Apply Online Process

Here is the complete process to make Pradhan Mantri Laghu Vyapari Maandhan Yojana online registration:-

- First of all, go to the NPS Traders Scheme official website at https://maandhan.in/

- At the homepage, scroll over “Services” section and click “New Enrollment” link or directly click https://maandhan.in/maandhan/login

- On clicking the link, Maandhan login page will appear as shown below:-

- It will have options for self enrollment (using mobile number & OTP), CSC VLE (using CSC connect) & Admin login (using admin credentials).

- Select the self enrollment tab to make National Pension Scheme for Traders and Self Employed Persons Login using mobile number.

- To make NPS Traders Scheme login using mobile, enter your 10 digit mobile number and click at “Proceed” button. Then an OTP would be sent on your registered mobile number.

- Enter OTP received on registered mobile number and click at “Proceed” button. Then PM laghu vyapari mandhan yojana dashboard will open.

- At the NPS Traders and Self Employed Persons dashboard page, scroll over “Services” section and click “Enrollment” tab.

- It will show names of 3 schemes. Then select name of the scheme as “National Scheme for Traders and Self Employed Persons” as given here.

- Then it will ask whether you are registered on e-shram or not. Only those candidates who are already registered on e-shram can apply online for NPS Traders and Self Employed Persons scheme. So, select “Yes” option.

- Accordingly, PM Laghu Vyapari Mandhan Yojana online registration form 2024 will appear as shown below:-

- Fill the details in the form to complete National Pension Scheme for Traders and Self Employed Persons online registration form filling process.

Also Read: PM Shram Yogi Mandhan Yojana Registration

Details to be Filled in NPS Traders Subscriber Enrollment Form

- Enter eShram UAN Number

- Enter Date of Birth

- Enter Aadhaar Number

- Verify Eshram Number

- Enter Email ID

- Enter Mobile Number

- Verify Mobile Number

- Select State from the drop down

- Select District from the drop down

- Enter the Pincode

- Select if the beneficiary belong to North Eastern Region (NER)

- Select whether member / beneficiary of NPS/ESIC/EPFO

- Select whether Income Tax Payer.

- Select Your Annual Turnover from the drop down

- Enter GSTIN Number

- Whether Member / Subscriber Of Prandhan Mantri Shram Yogi Maandhan / Prandhan Mantri Kisan Maandhan

- Read the consent and provide the consent

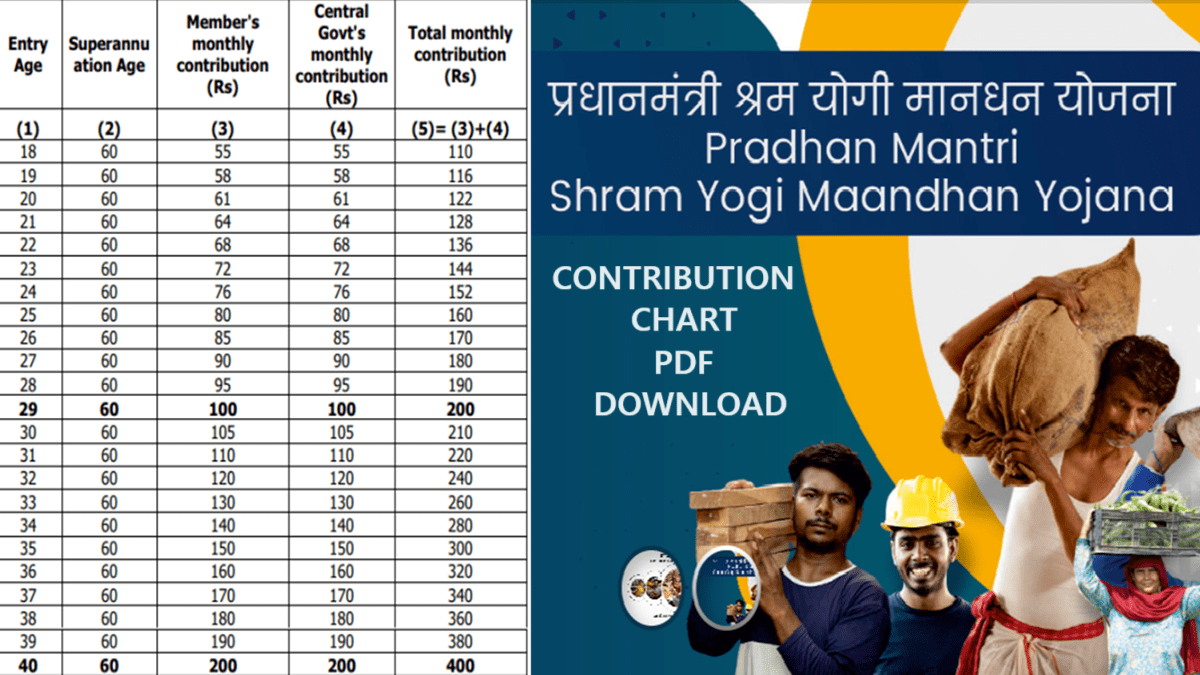

PM Laghu Vyapari Mandhan Yojana Contribution Chart

| Entry Age(A) | Superannuation Age(B) | Member’s Monthly Contribution(Rs)(C) | Central Govt’s Monthly Contribution(Rs) (D) | Total Monthly contribution(Rs)(Total= C+D) |

|---|---|---|---|---|

| 18 | 60 | 55 | 55 | 110 |

| 19 | 60 | 58 | 58 | 116 |

| 20 | 60 | 61 | 61 | 122 |

| 21 | 60 | 64 | 64 | 128 |

| 22 | 60 | 68 | 68 | 136 |

| 23 | 60 | 72 | 72 | 144 |

| 24 | 60 | 76 | 76 | 152 |

| 25 | 60 | 80 | 80 | 160 |

| 26 | 60 | 85 | 85 | 170 |

| 27 | 60 | 90 | 90 | 180 |

| 28 | 60 | 95 | 95 | 190 |

| 29 | 60 | 100 | 100 | 200 |

| 30 | 60 | 105 | 105 | 210 |

| 31 | 60 | 110 | 110 | 220 |

| 32 | 60 | 120 | 120 | 240 |

| 33 | 60 | 130 | 130 | 260 |

| 34 | 60 | 140 | 140 | 280 |

| 35 | 60 | 150 | 150 | 300 |

| 36 | 60 | 160 | 160 | 320 |

| 37 | 60 | 170 | 170 | 340 |

| 38 | 60 | 180 | 180 | 360 |

| 39 | 60 | 190 | 190 | 380 |

| 40 | 60 | 200 | 200 | 400 |

Also Read: PMSYM Contribution Chart PDF Download

About NPS Traders Scheme 2024

- NPS Traders Scheme is a voluntary and contributory pension scheme.

- Monthly contribution ranges from Rs. 55 to Rs. 200 depending upon the entry age of the beneficiary.

- Under this schemes, 50% monthly contribution is payable by the beneficiary and equal matching contribution is paid by the Central Government.

NPS Traders Scheme Eligibility Criteria

- Should be an Indian Citizen

- Shopkeepers or owners who have petty or small shops, restaurants, hotels, real estate brokers etc.

- Age of 18-40 years

- Not covered in EPFO/ESIC/PM-SYM

- Annual turnover not more then 1.5 Crore in rupees

Also Read: PM Kisan Mandhan Yojana Registration

Benefits of NPS Traders and Self Employed Persons Scheme

- Assured pension of Rs. 3000/- month to shopkeepers or owners who have petty or small shops, restaurants, hotels, real estate brokers etc. on attaining the age of 60 years.

- Voluntary and Contributory Pension Scheme.

- Matching Contribution by the Government of India.

For more details, visit the official website https://labour.gov.in/nps-traders

![PM Kisan Mandhan Yojana Online Registration Form [y], Contribution Chart, Eligibility PM Kisan Mandhan Yojana Apply Online Process](https://hindustanyojana.in/wp-content/uploads/2024/08/pm-kisan-mandhan-yojana-apply-online-process.png)

![PM Shram Yogi Mandhan Yojana Online Registration Form [y] PM Shram Yogi Mandhan Yojana Apply Online Process](https://hindustanyojana.in/wp-content/uploads/2024/08/pm-shram-yogi-mandhan-yojana-apply-online-process.png)

![NPS Vatsalya Scheme Apply Online [y] - How to Open NPS Vatsalya Account NPS Vatsalya Scheme Apply Online Process](https://hindustanyojana.in/wp-content/uploads/2024/09/nps-vatsalya-scheme-apply-online-process.png)

![Check Unified Pension Scheme (UPS) [y] Features and Benefits Unified Pension Scheme Approved by Cabinet](https://hindustanyojana.in/wp-content/uploads/2024/08/unified-pension-scheme-approved-by-cabinet.png)